Market Picture

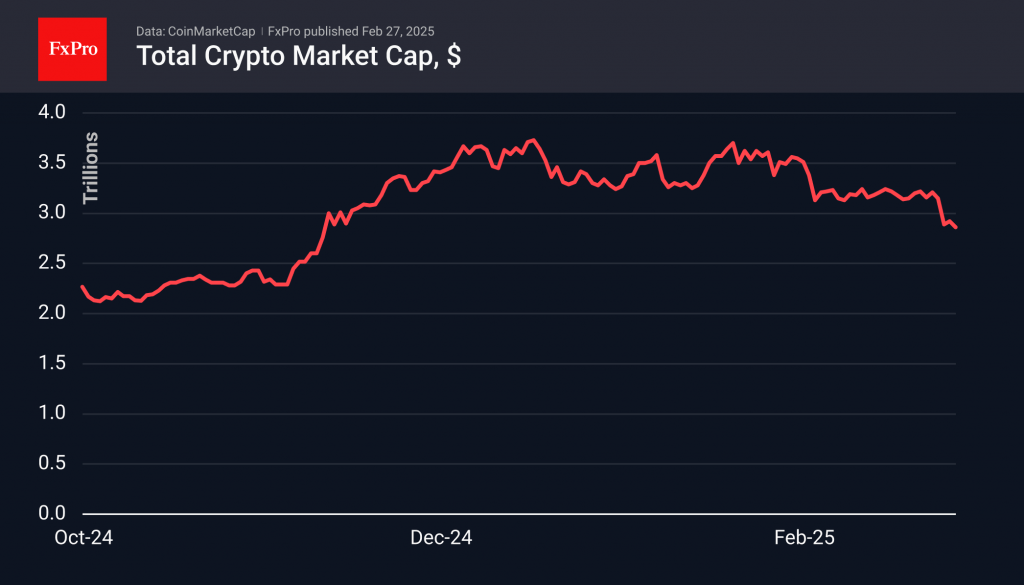

The cryptocurrency market stabilised in the first half of Wednesday, but by the end, a new wave of selloffs began, leading to new lows since early November at $2.75 trillion. In the morning, attempts were again made to stabilise the market. Increased trading activity was accompanied by increased volumes, indicating both accelerated liquidation of positions and interest in buying on declines.

The Fear and Greed Index fell to 10, which is an indicator of extreme fear and was last recorded in June 2022. The index has only been below this value for 19 days in its seven-year history. While the indicator is intended to be a good buy point, experience trading other markets suggests that this may be far from a lower price point.

Bitcoin is trading around the $86,000 mark, although the previous evening, it was approaching $82,000 and touching its 200-day moving average. Earlier in the week, the consolidation pattern was broken, and now market participants are trying to determine the endpoint of the decline.

Unusually, the largest altcoins remained within the range established the day before despite the significant decline over the week.

News Background

Institutional investor demand for BTC has reached its limit, according to QCP Capital. The period of high uncertainty in the market will continue for a few more weeks against the backdrop of the Trump administration’s decision to impose duties on goods from Canada and Mexico, as well as to limit investments of Chinese companies in the American economy.

Experts at QCP Capital warn that in volatile markets, cryptocurrencies remain the first assets to be liquidated as traders seek to reduce risk.

In Ethereum options, open interest in contracts with a $2000 strike is growing, reflecting investor caution. At the same time, CF Benchmarks noted a rotation out of calls as market participants reduced expectations of a breakout.

The US Department of Justice has allegedly initiated an investigation into Argentine President Javier Miley’s role in promoting LIBRA, according to the Argentine publication La Nacion.

The FxPro Analyst Team