Market Overview

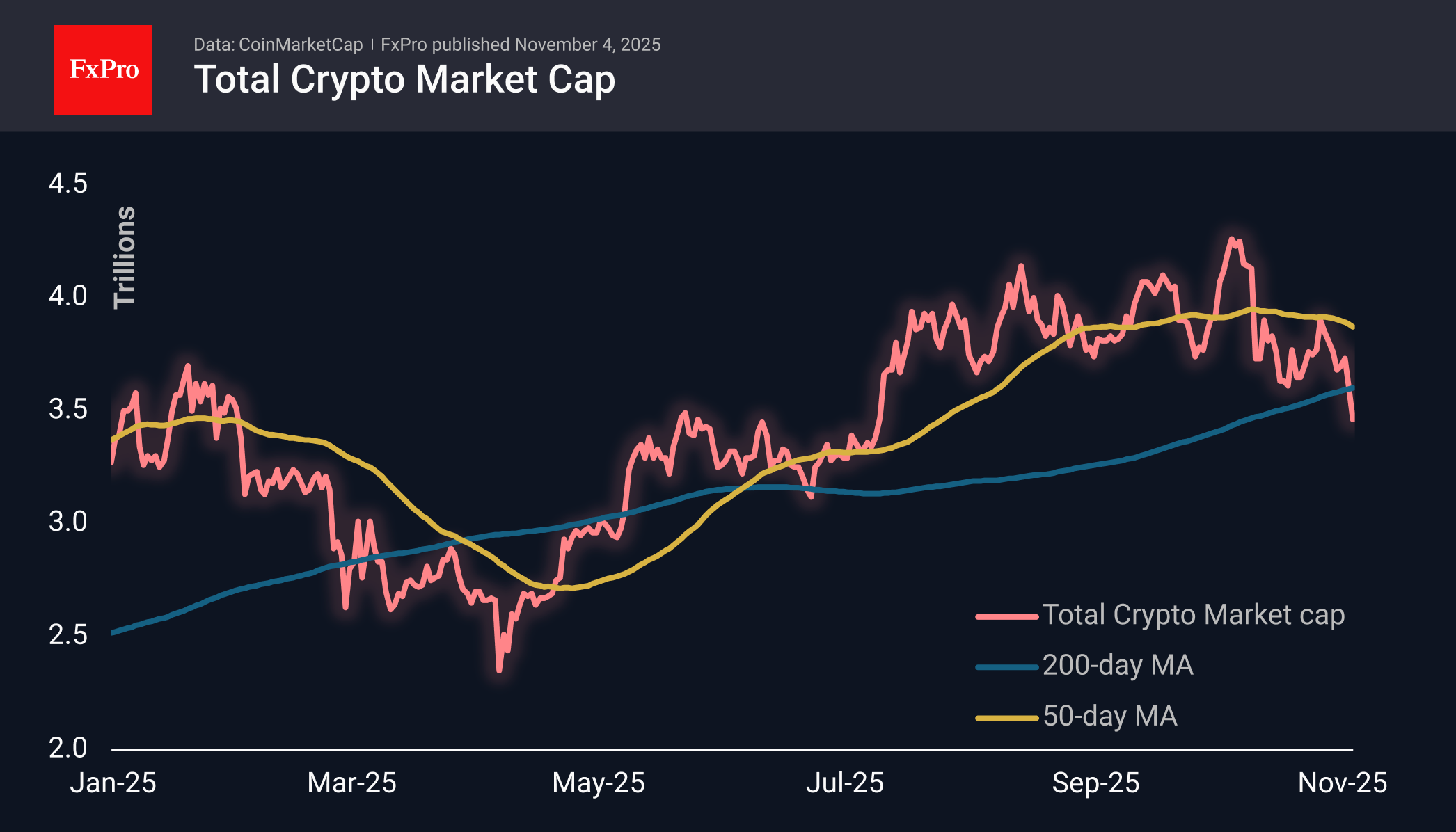

The crypto market cap has fallen to $3.47 trillion. This is 4% lower than the previous day and 19% off from the global peak set just four weeks ago. Sellers are pushing cryptocurrencies into bear market territory (unofficially, this occurs when there is a 20% decline from the peak) in the hope that the sell-off will be self-sustaining near this point. However, we are also seeing signs of a similar accelerated sell-off at the start of the week, following a lull from Friday to Sunday.

The sentiment index has fallen to 21, the lowest level since 9 April, indicating extreme fear. Last month, entering this territory triggered a rebound, but the market has already fallen below those levels. As we previously suggested, the initial surge of extreme fear levels is only the beginning of a prolonged period of volatility in this territory. This period is also characterised by an even more substantial decline in altcoins compared to the first cryptocurrency.

Bitcoin plummeted below $ 105K, shedding nearly 3% in the past 24 hours. Excluding short-term slips last month, BTC has not traded lower since June. By and large, it is now testing levels that served as resistance last December and January.

News Background

According to CoinShares, global investment in crypto funds declined by $360 million last week, following inflows the week before. Only investments in Bitcoin declined, by $946 million. Investments in altcoins increased, with notable gains in Ethereum by $58 million, in Solana by $421 million, in XRP by $43 million, and in Sui by $9 million.

QCP Capital recorded large transfers of Bitcoin to the Kraken exchange by early investors. According to analysts, the current consolidation resembles the period before the breakthrough in 2024. Otherwise, it could signal the beginning of a crypto winter.

Bitcoin is not showing growth as early investors pass the baton to long-term holders. The recovery of the first cryptocurrency is only possible after the ETF and Strategy resume large-scale purchases, according to CryptoQuant.

Strategy bought 397 bitcoins last week at an average price of $114,771. Strategy now owns 641,205 BTC worth $47.49 billion at an average purchase price of $74,057 per coin. The company’s weekly BTC purchase volumes remain close to record lows.

Another record was set in October by the Ethereum network, with stablecoin transactions reaching $2.8 trillion last month. Circle’s USDC was the leader, accounting for $1.6 trillion of the total turnover.

The FxPro Analyst Team