The crypto market capitalisation fell to 1.83 trillion, losing 7.3% in the past 24 hours. As we had feared, the selloff was triggered by sharply negative sentiment in US equity markets and intensified by the breakdown of critical support levels.

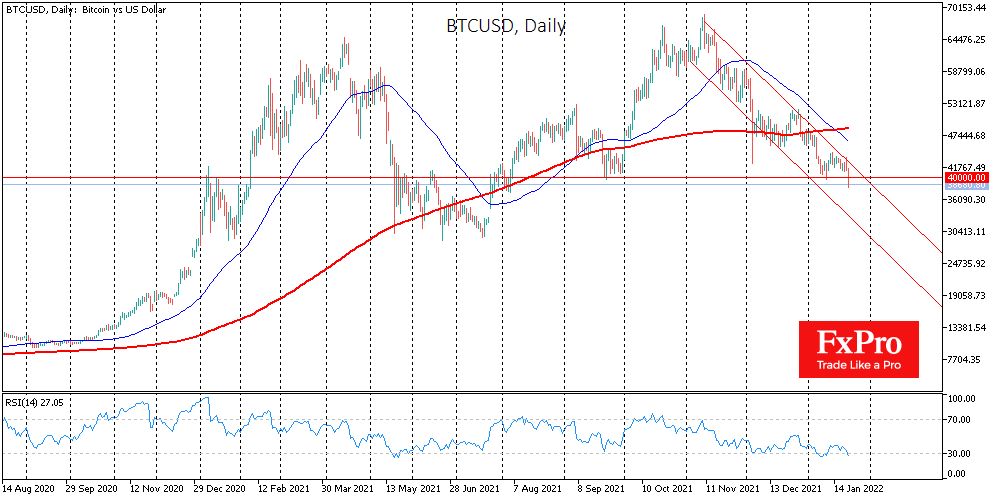

Bitcoin retreated to the $38.8K area. The amplitude of the decline from the peak at the start of the regular session in New York to the bottom at the opening of Asia exceeds 12%. Sellers have proven unbreakable (so far) the upper boundary of the downward price channel that has dominated bitcoin since mid-November.

Another worrying fact is that Bitcoin’s share has risen to 40.2% of the crypto’s total cap. The implication is that investors are breaking out of altcoins even more sharply, as they are less confident in the ability of smaller coins to withstand the titans’ fall.

Without a sharp intraday reversal (chances for this are minimal), we can confidently expect an acceleration of long position liquidation in Bitcoin and further drawdowns. There is nowhere to look for support until the $30-33K area on the chart.

Ether has given up support at $3K, quickly pulling back into the consolidation area of late September, ending up near $2.85K. The intensification of the selloff makes $2K the target of the initial downside wave.

Earlier in 2021, the area of 30K for Bitcoin and near 2K for Ether was the bottom of a deep correction. This then attracted buyers, and the total market managed to rewrite highs. In that drawdown, the total capitalisation of cryptocurrencies was down to $1.2 trillion. If the first two cryptocurrencies were targeting lows last summer, it is logical to expect the entire market to return to the lows of that time.

But then the external backdrop was highly favourable, as the US market was returning to growth with drawdowns in the 5% range, having already crossed that barrier earlier last year. The continued negative backdrop in equities sets up a deeper pullback in crypto. The crypto market’s capitalisation could potentially shrink by half to the $830-900bn area before we see a new wave of long-term buyer inflows. For Bitcoin, this suggests the potential for a drop to 20K.

The FxPro Analyst Team