Market Picture

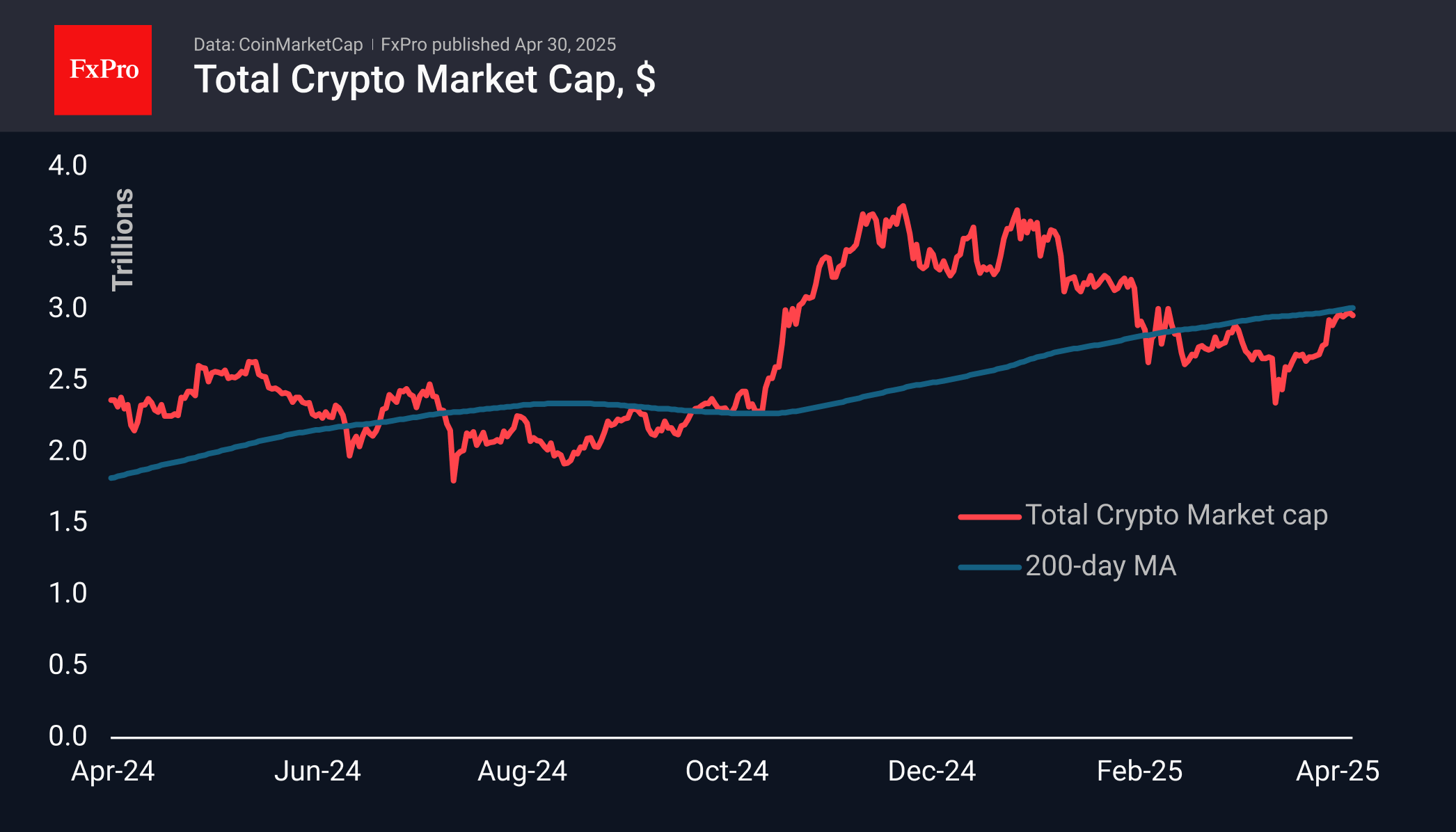

The crypto market remains in prolonged consolidation as it approaches the $3 trillion level, losing about 0.5% over the past day. For the past five days, the market has fluctuated in a very narrow range, with some tendency towards shallower declines. Still, it has been unable to exceed its 200-day moving average, which is now passing through $3.01 trillion. A global positive is needed for a breakout, but it would open the way to the $3.50 trillion area.

Bitcoin is hovering near $94,500, forcing the entire cryptocurrency market to watch for the next move. Such long consolidations usually accumulate strength for further movement. The next major trigger is likely to be Friday’s labour market data.

Ethereum continues to struggle with its downtrend, hovering around the $1,800 for the past seven days, right where the 50-day moving average and the resistance line of the descending channel converge.

An upward momentum would be an important positive signal, but theoretically, under these conditions, the baseline scenario is a downward reversal.

News Background

Presto Research predicts that Bitcoin will reach $210,000 by the end of this year. Growing institutional interest and rising global liquidity will be the primary drivers behind its price increase.

Bitwise believes that Bitcoin’s recent rise above $94,000 occurred with minimal participation from retail investors. The current rally has been initiated by institutional investors, financial advisors, corporations, and even governments. The list of investors buying BTC is expanding.

The growing share of bitcoins purchased at lower prices indicates that the rally is approaching a ‘historic level of euphoria,’ according to Darkfost, an analyst at CryptoQuant.

Crypto Caesar analyst believes that breaking through the psychological level of $100,000 will pave the way for Bitcoin to new all-time highs in the range of $110,000-115,000.

The FxPro Analyst Team