Market Picture

The cryptocurrency market lost 0.2% in 24 hours to $2.12 trillion but saw a fresh drop in the US session during the day before rebounding on buying in lower volumes in Asian trading on Friday morning. The Sentiment Index fell to its lowest level in over a month at 32 (fear).

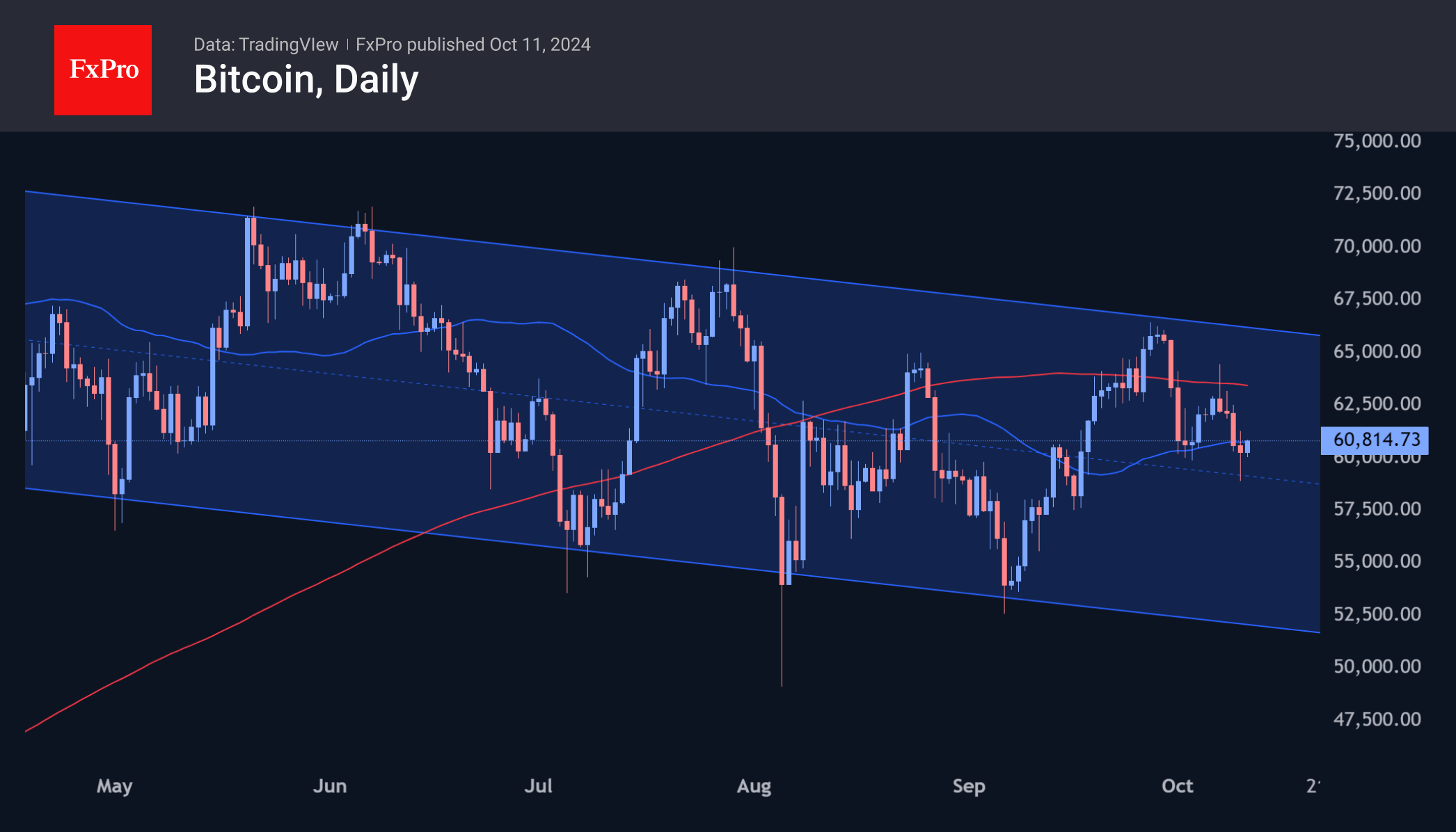

Since the beginning of the week, Bitcoin’s intraday momentum has been dominated by declines during the US session. The intensification of the sell-off was clearly visible on Wednesday and Thursday, with losses from peak to trough exceeding 3%. The first cryptocurrency fell below $59K before recovering to $60.5K at the time of writing. The momentum of the previous day’s sell-off sent BTCUSD below its 50-day MA, and on the morning’s recovery, the price is attempting to move higher again.

Ethereum was back at $2,400 on Friday, where it started the week. The rally we saw at the end of last week failed to develop, and the failure to make the local low was another touch of the 200-week MA, a long-term support line from which it has failed to break away for the ninth week. Ethereum was only weaker in 2020.

News Background

According to QCP Capital, the rise in funding rates for perpetual contracts indicates the cryptocurrency market’s vulnerability to a correction. In the medium and long term, the experts remain bullish and recommend applying accumulation strategies, betting on the short-term nature of the correction.

OXT Research noted that some 7,000 ETH worth $16.7 million seized from the organisers of the PlusToken cryptocurrency pyramid scheme have been transferred to exchanges. This could mean the sale of all remaining 542K ETH worth $1.3 billion. The vast majority of PlusToken’s bitcoins, about $1.3 billion, were sold between 2019 and 2020.

SEC chief Gary Gensler said Bitcoin and other cryptocurrencies will be seen in the future as a store of value rather than a widely used payment instrument. He cited the 19th-century Copernicus-Gresham Law, which states that ‘bad money drives out good money’ and that countries prefer to have only one type of money.

Nobuaki Kobayashi, the trustee of bankrupt crypto exchange Mt. Gox, said in an official letter that the deadline to compensate affected creditors will be extended for another year, until 31 October 2025.

The FxPro Analyst Team