Market Overview

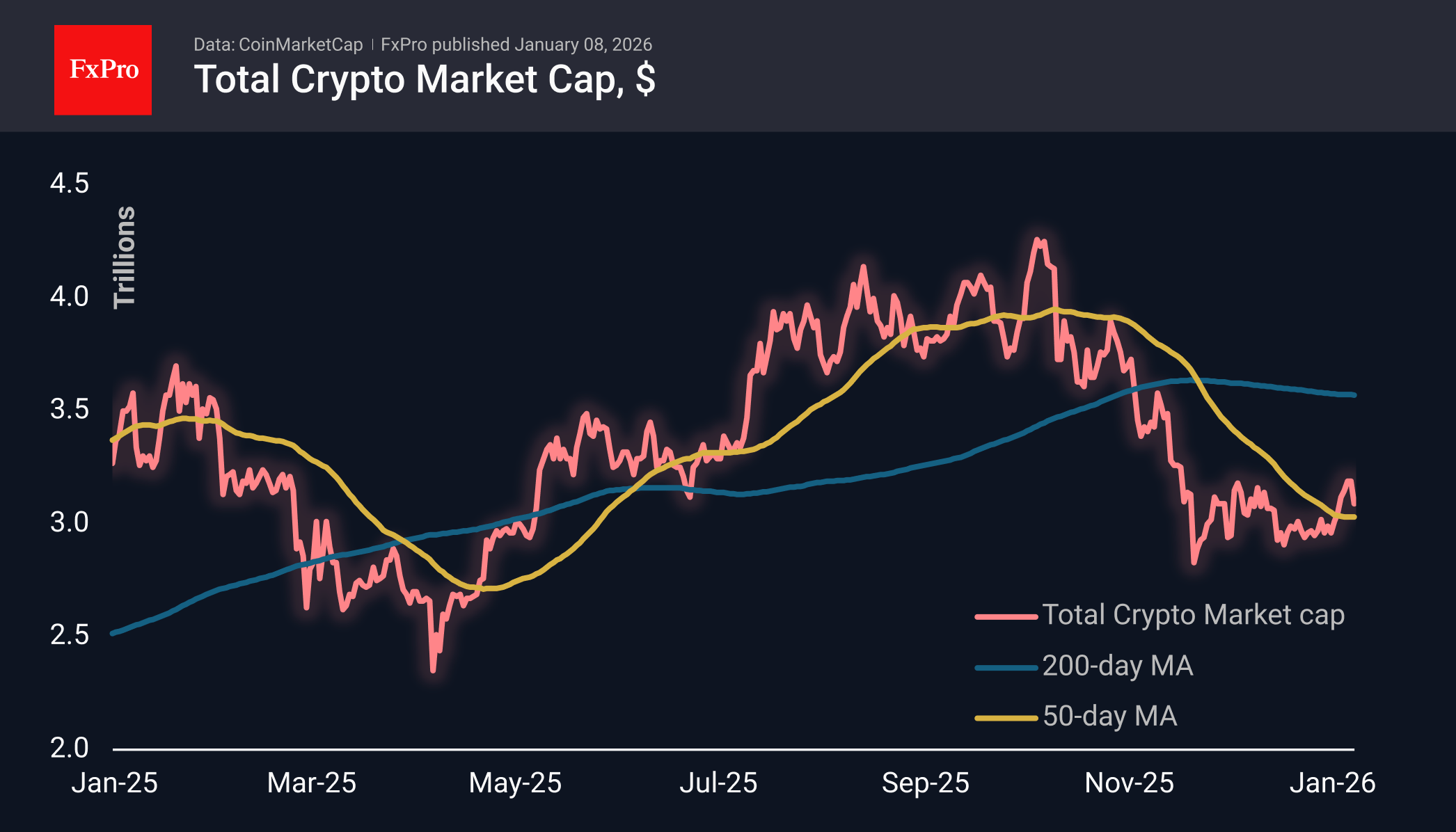

The crypto market remained under pressure throughout Wednesday and early trading on Thursday, losing about 4% of its capitalisation to $3.08 trillion over the day. The market once again confirmed its cautious sentiment, retreating from the upper boundary of the consolidation range of the last eight weeks. The retreat of the stock markets created an unfavourable backdrop, and cryptocurrencies were unable to move from a rebound mode after the decline to a full-fledged recovery.

Bitcoin plunged below $90K on Thursday morning after bears seized the initiative at the end of the day on 5 January. At its lowest point, BTC approached the 50-day moving average, above which it climbed at the start of the year. The end of the week will bring an answer to the question of whether this curve has become a support level or whether we saw a false breakout at the start of the year.

News Background

Bitcoin could reach a new all-time high this year, said Bill Miller, investment director at Miller Value Partners. According to him, major Wall Street players are once again showing interest in the asset.

Institutional investors are again buying more Bitcoin through ETFs than miners are mining per day, notes analyst Charles Edwards. On-chain demand is still weak, but there are signs of a return of liquidity on Binance.

The main catalyst for Ethereum’s growth in the new year will be crypto neobanks, not speculative traders, according to Ether.fi. Such platforms are capable of attracting many more crypto users than spot ETFs.

On 7 January, Ethereum developers implemented the Blob Parameter-Only (BPO) fork on the main network, which increases the BLOB object limit from 15 to 21. This will allow more transactions to be processed simultaneously, increasing the efficiency of the blockchain without the direct risk of overload.

Ripple has announced that it has no plans to go public, despite Wall Street’s $40 billion valuation. Ripple’s strong institutional support and overall treasury size have virtually eliminated the need for additional funding.

Privacy is a critical feature necessary for the development of global finance on the blockchain, which is why it will become a major focus in the crypto industry in 2026, according to a16z crypto.

The FxPro Analyst Team