Market picture

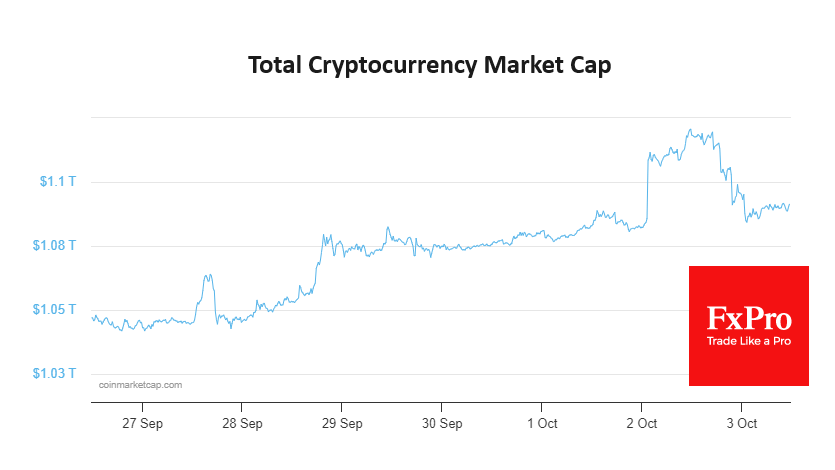

Crypto market capitalisation fell by 2.5% to $1.09 trillion. The market failed to accelerate but remains in an uptrend despite the general decline in demand for risk assets.

After peaking above $28.5K on Monday, Bitcoin gradually slid shortly after the main US session. At one point on Tuesday morning, the price fell to $27.3K, where the first cryptocurrency found buyers. However, it’s easy to see that buyers dominate in a calm state. Excluding short-term spikes and pullbacks, it is easy to see a steady upward trend since the 25th of September.

Bitcoin received support when it touched the area of previous highs, turning resistance into support. This is a bullish sign that sets up another test of the 200-day ($28K) with potential for further strength.

News background

The main factors holding back further growth in the asset are the SEC’s strict policies and global recession risks.

According to CoinShares, investments in crypto funds rose by $21 million last week after six weeks of outflows. Bitcoin investments increased by $20 million, while Ethereum investments fell by $1.5 million. Solana investments rose sharply, up $5 million at a time.

Grayscale has filed with the SEC to convert the Grayscale Ethereum Trust into a spot Ethereum ETF. The company expects this to “expand the regulatory boundaries” of the leading altcoin in the US.

UBS Asset Management, one of the world’s most significant stock market players, has launched the first tokenised money market fund pilot on the Ethereum blockchain.

The total value locked (TVL) in the Solana blockchain exceeded $339 million, the highest since November 2022. However, the current figures are still far from the historic highs of November 2021, when the ecosystem’s TVL reached nearly $10 billion.

The FxPro Analyst Team