Market picture

The crypto market has lost another 0.8% of its capitalisation in the last 24 hours, rolling back to $1,128, where it was last Friday. Bitcoin is down 1.4%, Ether is down 0.8%, and the top altcoins are mostly down, except for Litecoin, which is up 3%.

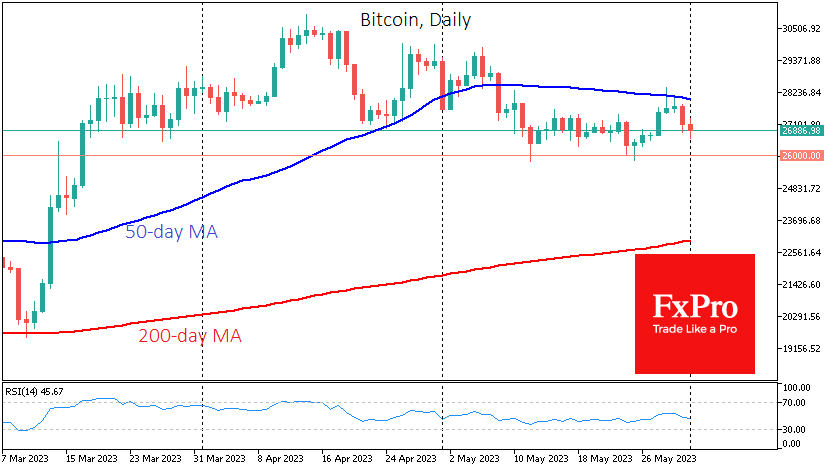

Bitcoin closed the month down 7.6% at $27.0K, having gained every month since the beginning of the year. With further declines, the momentum towards the $25.5-26.0 area is worth a closer look. There is a 50-week average near the lower boundary, while at the top, bitcoin found support on May’s declines.

Ethereum failed to stick to levels above its 50-day moving average and pulled back to $1850. The following technical support is at $1800.

A solid move below these areas in Bitcoin and Ether will likely trigger a broader sell-off in altcoins.

Regarding seasonality, June is considered a relatively successful month for BTC. Over the past 12 years, bitcoin has ended the month up seven times (up 16.7% on average) and down five times (-19.2% on average).

News background

According to the Financial Times, the world’s biggest banks, including Standard Chartered, Nomura and Charles Schwab, are developing cryptocurrency trading platforms. Institutional investors remain interested in investing in digital assets but only trust the big banks.

Blockchain industry veteran and Bitcoin Cash supporter Roger Ver believes that Ethereum, despite its smaller capitalisation, has become “a driving force for cryptocurrency adoption worldwide”. According to him, ETH has brought innovations such as NFT, smart contracts, scaling solutions and so on to the industry.

The Binance exchange has expressed support for potential US Republican presidential candidate Ron DeSantis for his intention to oppose any form of cryptocurrency prohibition.

According to Wu Blockchain, the world’s largest cryptocurrency exchange Binance plans to cut a fifth of its staff in June.

Tron developers have patched a critical vulnerability that exposed $500 million in assets.

The FxPro Analyst Team