Market picture

The total capitalisation of cryptocurrencies has declined by almost 2% to $1.54 trillion in the past 24 hours. This is still a move in the opposite direction relative to the US and European indices, which are rising. Given that the current year is marked by impressive growth in cryptocurrencies, profit-taking looks like a logical end to it.

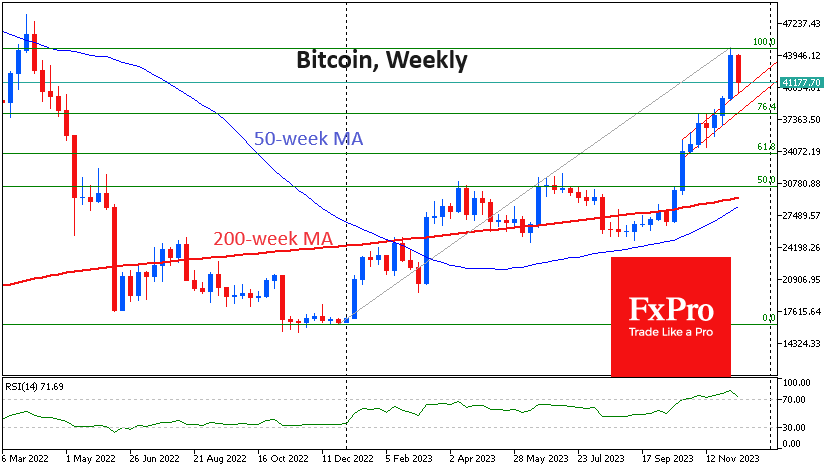

Bitcoin has gained more than 170% from the start of the year to its peak last week. The levels of $38K and $34K look like potential targets for a full-fledged correction. At the same time, locally, Bitcoin is being actively bought back at levels above $40.5K, clearly protecting a significant round level.

A failure under it is likely in case of a reversal of stock indices and a widespread thrust from risky assets, which has not been observed yet. The Fed has a chance to influence the situation later on Wednesday with its rate decision, which could determine demand for days and weeks to come.

News background

Avalanche (AVAX) has climbed into the top 10 cryptocurrencies with the highest market capitalisation, overtaking Dogecoin. The AVAX exchange rate has been up 57% in the last seven days; 30-day gains exceed 104%. Central banks, such as Bank of America, Citi, and JPMorgan, are looking at options to use the Avalanche blockchain to tokenise real-world assets. Bernstein predicts more robust demand for AVAX and further growth of the asset.

Cryptocurrency exchange KuCoin has reached a settlement agreement with the New York State Attorney’s Office to resolve claims it will pay more than $22 million. In March, the platform was accused of violating securities laws by unlicensed digital asset offerings.

El Salvador will launch Bitcoin-backed Volcano Bonds in the first quarter of 2024. They will be issued on Bitfinex Securities, a platform registered in El Salvador as a blockchain-based trading platform for stocks and bonds. According to CoinGecko, just 2 per cent of Salvadorans have become cryptocurrency investors after two years.

According to Circle, which issues the USDC stablecoin, there is now a boom in interest in blockchain and stablecoins. The global volume of stablecoin settlements exceeded $7 trillion last year. By comparison, Visa and Mastercard settlements totalled $14 trillion. Latin America is becoming the biggest consumer of digital currencies.

The FxPro Analyst Team