Market Picture

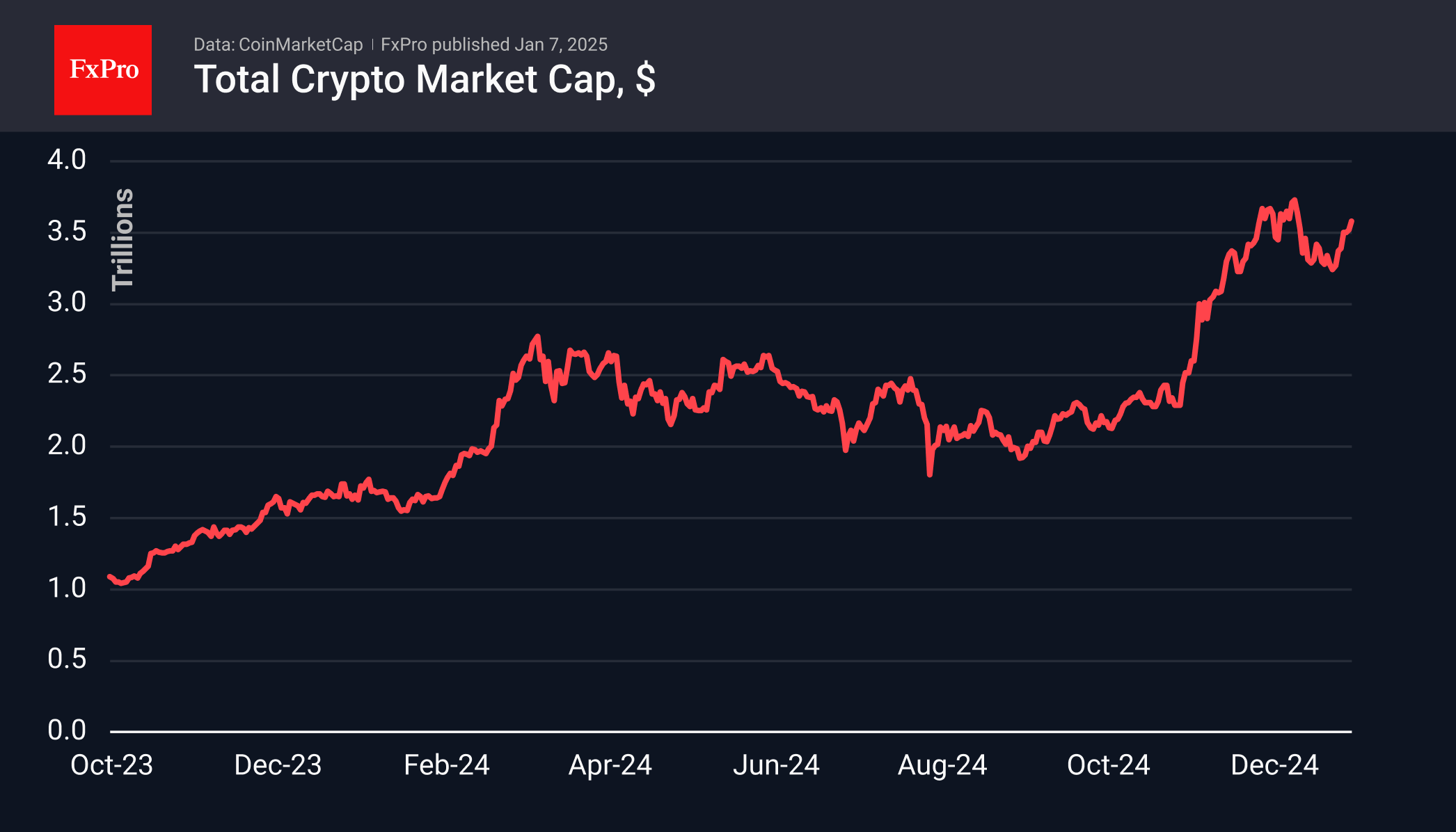

The crypto market has been on the rise since the beginning of the year. The 1.25% gain on the last day brought the gain since the beginning of January to 10%. At the current level of $3.58 trillion, the market has recovered around two-thirds of the losses since peaking at around $3.80 in mid-December. Interestingly, the market is not currently being held back by growing expectations of tighter monetary policy from the Fed.

The cryptocurrency Fear and Greed Index is back in extreme greed territory at 78. That’s high enough to indicate active buying interest but not too hot, leaving room for upside.

Bitcoin passed the $100K mark and climbed above $102K late on Monday. After rallying since early November, the first cryptocurrency completed a classic Fibonacci retracement and returned to growth. A break above the $110K level will initiate an expansion pattern with an upside potential of $134K.

News Background

According to CoinShares, global investment in crypto funds reached a record $44.2 billion in 2024, almost four times the previous record set in 2021. Bitcoin investment grew by $38 billion over the year and Ethereum by $4.9 billion.

Among other altcoins, $438 million went into XRP funds, $69 million into Solana and $53 million into Litecoin.

MicroStrategy bought 2,138 BTC for $209 million last week at an average price of around $97,837 per coin. The company holds 446,400 BTC on its balance sheet at an average price of $62,428.

Traders are focusing on call options with a strike price of $120,000. Key market catalysts are Trump’s inauguration on the 20th and the Fed’s rate decision on the 29th.

Miner MARA directed 7,377 BTC, or 16.4% of its bitcoin reserves, to cryptocurrency lending services to generate ‘modest’ additional income. The expected return on the contracts does not exceed 10% per year.

The FxPro Analyst Team