Market picture

Over the past 24 hours, the cryptocurrency market has lost more than 3.5%, falling to a capitalisation of $2.37 trillion. Bitcoin shows a decline with a similar amplitude; Ethereum lost less than 3%, while BNB added 0.1%, and Solana fell by 6.5%.

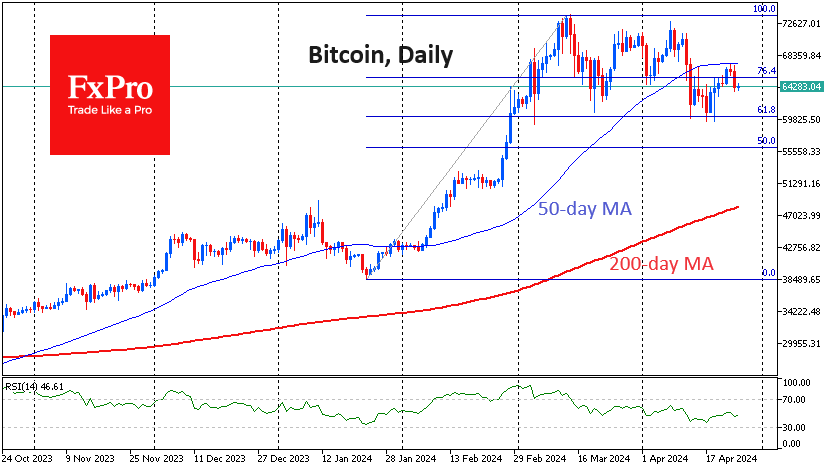

On Wednesday, Bitcoin retreated significantly from its 50-day moving average, which we see as an important manifestation of bearish strength. Most crypto traders clearly took this signal.

For example, on the daily charts of Solana and Cardano, the rebound over the past ten days now looks like a tactical retreat by the bears, who decided to sell the market again on Wednesday. It is worth keeping a close eye on whether selling can bring the price below the previous local lows, around $125 for Solana and $0.4 for Cardano.

News background

The possibility of creditors of bankrupt platform Mt.Gox selling 142,000 BTC (over $9bn) in the coming weeks could “spook the market” and put pressure on bitcoin, according to K33 Research. Mt.Gox is expected to distribute its assets of 142,000 BTC, 143,000 BCH and 69 billion yen to customers by 31 October 2024. Lenders will start receiving bitcoins as early as next month.

After the halving, demand for Bitcoin will be five times the supply due to the reduction in daily issuance volume, Bitfinex expects.

After the fourth halving, Bitcoin has finally displaced gold as the most deficit asset in the context of rising supply, Glassnode noted. Capital continues to flow into BTC despite “volatility, negative headlines and cyclical drawdowns”.

Standard Chartered, an investment bank, retreated its positive outlook on the spot Ethereum-ETF and now doubts the SEC will approve the instrument in May. The bank reiterated its previous forecast of $150K for Bitcoin at the end of 2024 and $8K for ETH. Cryptocurrencies may resume growth after the market’s congestion of longs is lifted.

Coinbase is launching a $15 million television advertising campaign to promote the benefits of crypto payments. The exchange will air three spots on four TV channels during the NBA playoffs broadcasts.

According to Bloomberg, trading of a spot bitcoin-ETF from Bosera Capital and HashKey Capital on the Hong Kong Stock Exchange will start on 30 April. The spot bitcoin-ETF was approved by the Hong Kong Securities and Futures Commission on 15 April.

The FxPro Analyst Team