Market Picture

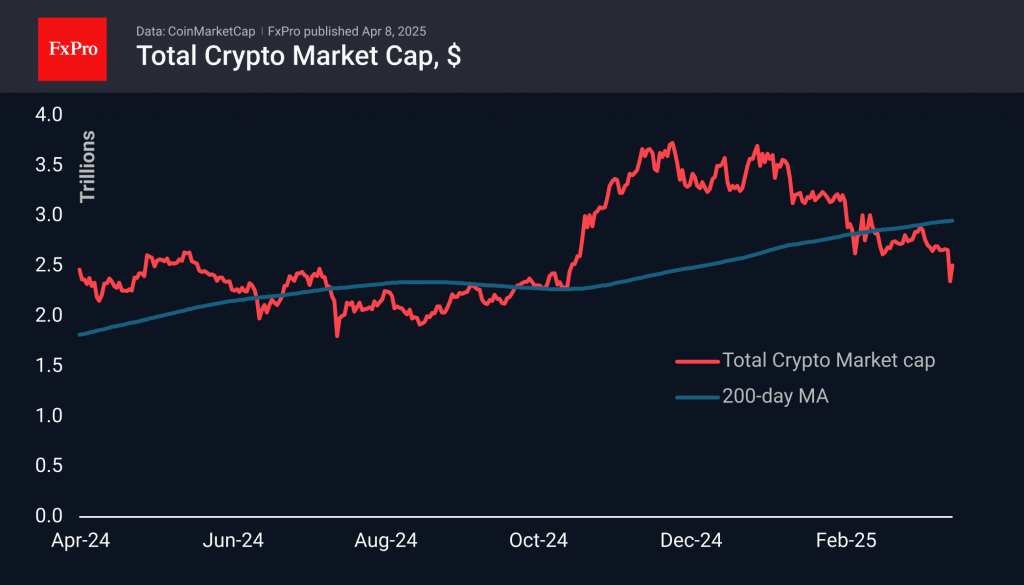

The cryptocurrency market found its footing on Monday with the start of active trading in Europe. However, that rebound from the $2.37 trillion level to $2.55 trillion appears to be losing steam. Even at current levels, the decline over the past seven days is over 8%. Without reliable signs of a reversal in the stock markets, the upward momentum could quickly fade. It looks like we are not seeing a reversal but only a stabilisation of the decline.

Bitcoin slipped below $75k at the start of the week, bouncing briefly above $80k on Monday and Tuesday. The technical picture for Bitcoin remains tragic. Earlier this month, a death cross formed when the 50-day average dipped below the 200-day. Last year, a similar signal had the opposite effect, recording a low a couple of days before the signal. But in the last couple of months, the downward trending 50-day has been acting as an effective resistance. In case of a market reversal, a consolidation above the 86k level, where it is now, would be an important signal of a break in the downtrend.

News background

According to CoinShares, global investments in crypto funds fell by $240 million last week after two weeks of inflows. Bitcoin investments decreased by $207 million, Ethereum by $38 million, Sui by $5 million, and Solana by $2 million, while XRP investments increased by $4.5 million and Toncoin by $1 million.

Coinshares suggests that the outflow of funds from cryptocurrencies is likely a response to recent news of US trade duties that pose a threat to economic growth.

Binance Research noted that macroeconomic factors like trade policy and rate expectations are increasingly driving cryptocurrency market behaviour, temporarily overshadowing underlying demand dynamics. Bitcoin’s correlation with traditional assets tends to rise during times of acute stress but weakens as conditions normalise.

Bitcoin’s hash rate surpassed the 1 ZH/s (zeta hash) mark for the first time in history. On 5 April, mining difficulty hit a record high (ATH) at 121.51 T. Meanwhile, the profitability of mining is under serious pressure due to falling BTC value and transaction fees.

Strategy company reported unrealised losses of $5.91 billion for Q1 2025.

The FxPro Analyst Team