Market Overview

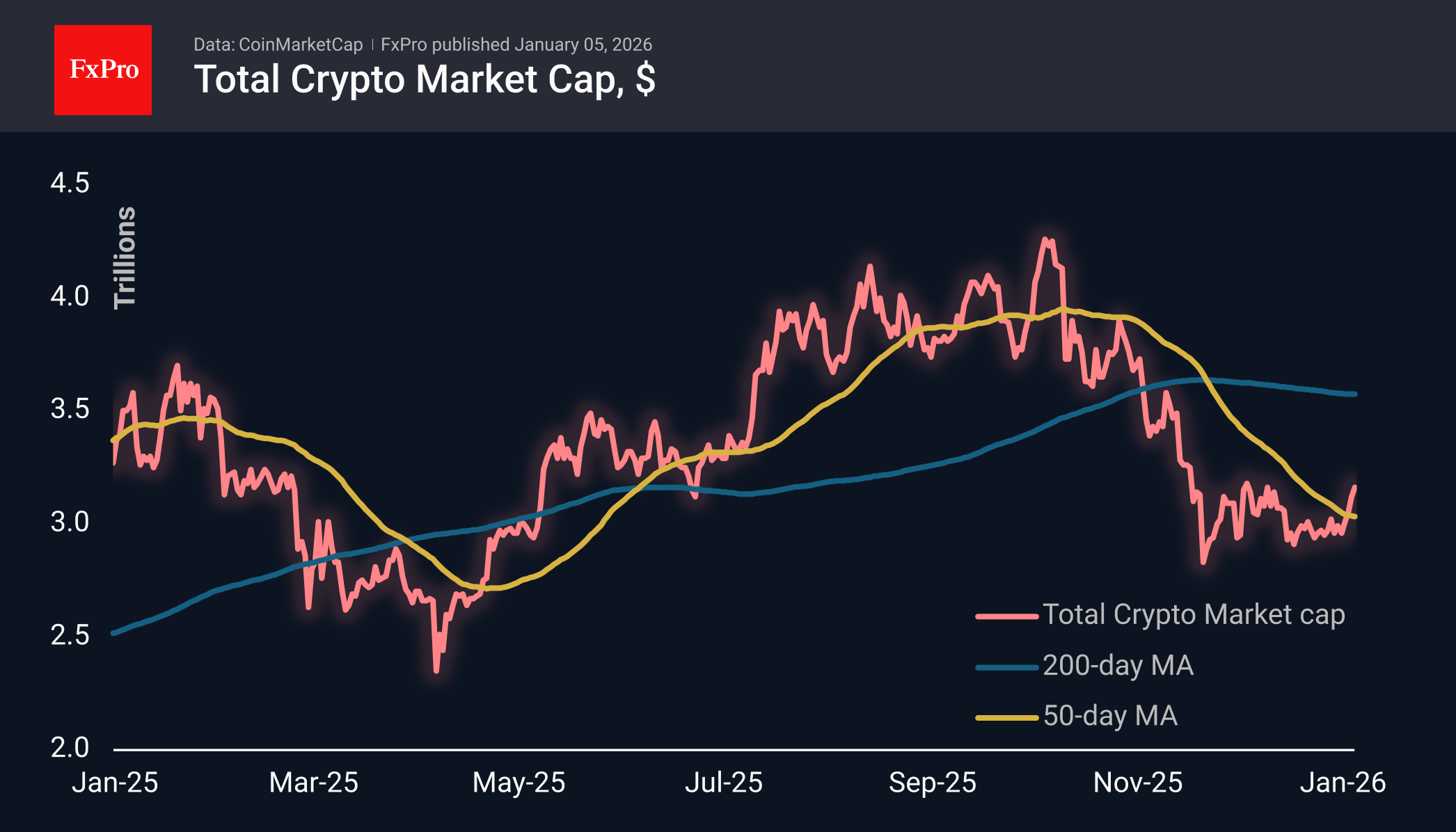

The cryptocurrency market added 3.6% to its capitalisation over the past seven days and approximately 0.6% in 24 hours, reaching $3.14 trillion. At the start of trading on Monday, there was a slight decline to $3.18 trillion, but a return to monthly highs attracted local buyers. Active growth since the beginning of the year has not only pushed the market away from the ‘bottom’ where prices had been hovering for two weeks prior, but also ensured a break above the 50-day moving average, which we have not seen in almost three months. In the near term, we are closely monitoring the market’s attempts to consolidate at $3.20T. An increase in selling will confirm the shift to a bear market. The ability to grow will indicate the end of a long and relatively deep correction, setting the stage for a rapid approach to highs above $4T. By default, we are in favour of a bearish scenario until proven otherwise.

Bitcoin surpassed the $92K mark, marking its fifth consecutive daily growth candle today and reaching its highest level since December 12th. Last month, market participants actively sold off the first cryptocurrency in the $92–95K range, halting attempts to form a rebound after the October-November sell-off. Has the market changed during this time? It is unlikely that it has become stronger, with no prospects for accelerated economic growth or more dovish monetary policy sentiment.

News Background

Retail investors actively bought Bitcoin in the second half of last year, while large players were passive or took profits at October highs. Santiment calls this dynamic alarming. At the same time, there has been a decline in interest in the asset in the media and on social networks.

In December, large holders sold 20,000 BTC. However, the volume of leveraged positions grew by $2.4 billion, despite a 40% decline in trading activity, notes analyst Crazzyblockk. The current market situation does not signal that the bottom has been reached.

Long-term Bitcoin holders have stopped selling for the first time since July, according to VanEck. The current sideways movement of Bitcoin against the backdrop of record growth in gold and silver is comparable to the ‘calm before the storm,’ which is usually followed by a rally in the crypto market, a Bull Theory analyst hopes.

According to Lookonchain, an investor with $11 billion in assets has opened long positions on futures for the three leading cryptocurrencies worth $749 million. In October, he correctly predicted the market crash.

In the near future, Bitcoin and Ethereum are expected to receive a significant influx of capital due to the end of the rally in the precious metals market, according to Garrett Jean, former CEO of the now-defunct BitForex exchange.

According to Etherscan, the Ethereum network set a new record of 2.2 million transactions processed per day. Transaction costs fell to historic lows ($0.17).

Bitcoin has now turned 17. The anonymous creator of Bitcoin, under the pseudonym Satoshi Nakamoto, launched the network for the first cryptocurrency on January 3rd 2009. It was on this day that the very first block in the network was created, known as the genesis block, which contained 50 BTC.

The FxPro Analyst Team