Bitcoin has added 7.4% to $24.6K in the last 24 hours. It’s not the magnitude of the move that draws attention but rather the ability to rewrite previous local highs. Ethereum has gained 13% to $1900 in the same time frame. Top altcoins add between 4.7% (BNB) and 13.4% (Solana).

The total capitalisation of the crypto market, according to CoinMarketCap, rose 7.4% to $1.16 trillion overnight.

Bitcoin jumped on Wednesday, and stock indices on US inflation data showed a more robust cooling, fuelling speculation that the Fed will soon soften its tone.

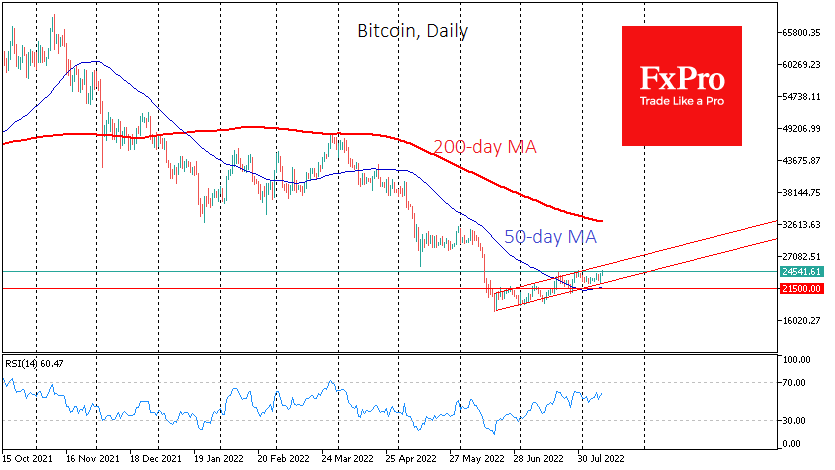

On Thursday morning, BTCUSD, after three weeks of unsuccessful attempts, managed to gain ground above $24K and quickly moved into the $24.5K area. These are the highest levels since mid-June when bitcoin literally crashed. Now up to $30K, there are no significant technical obstacles.

On the other hand, the benchmark crypto pair is still moving within a moderate upward trend, with the upper boundary now at $25.5K. Moving within this range, BTCUSD will be at 30K only by October.

Ethereum is showing much more resurgence right now. Expectations of an imminent switch to proof-of-stake are a significant market driver. As a result, ETHUSD has already recouped all losses since June, recovering to previous consolidation levels.

Ether’s dominance has recovered to 19.9%. The second most popular cryptocurrency has not had a sustainable share since 2017, but last year we saw a steady climb towards these levels due to the increased use of Ether in other projects. The next significant milestone for ETHUSD looks to be the $2300 area, where the 200-day moving average and the lows of the dips earlier in the year are concentrated.

We also note the drop in the bitcoin dominance index to 40%. For the past five years, a dip under this mark has often been followed by aggressive profit-taking in altcoins, whether we are in bull or bear markets. In our case, it may not mean the impending collapse of altcoins but rather an acceleration of BTC’s growth.

The FxPro Analyst Team