Market Picture

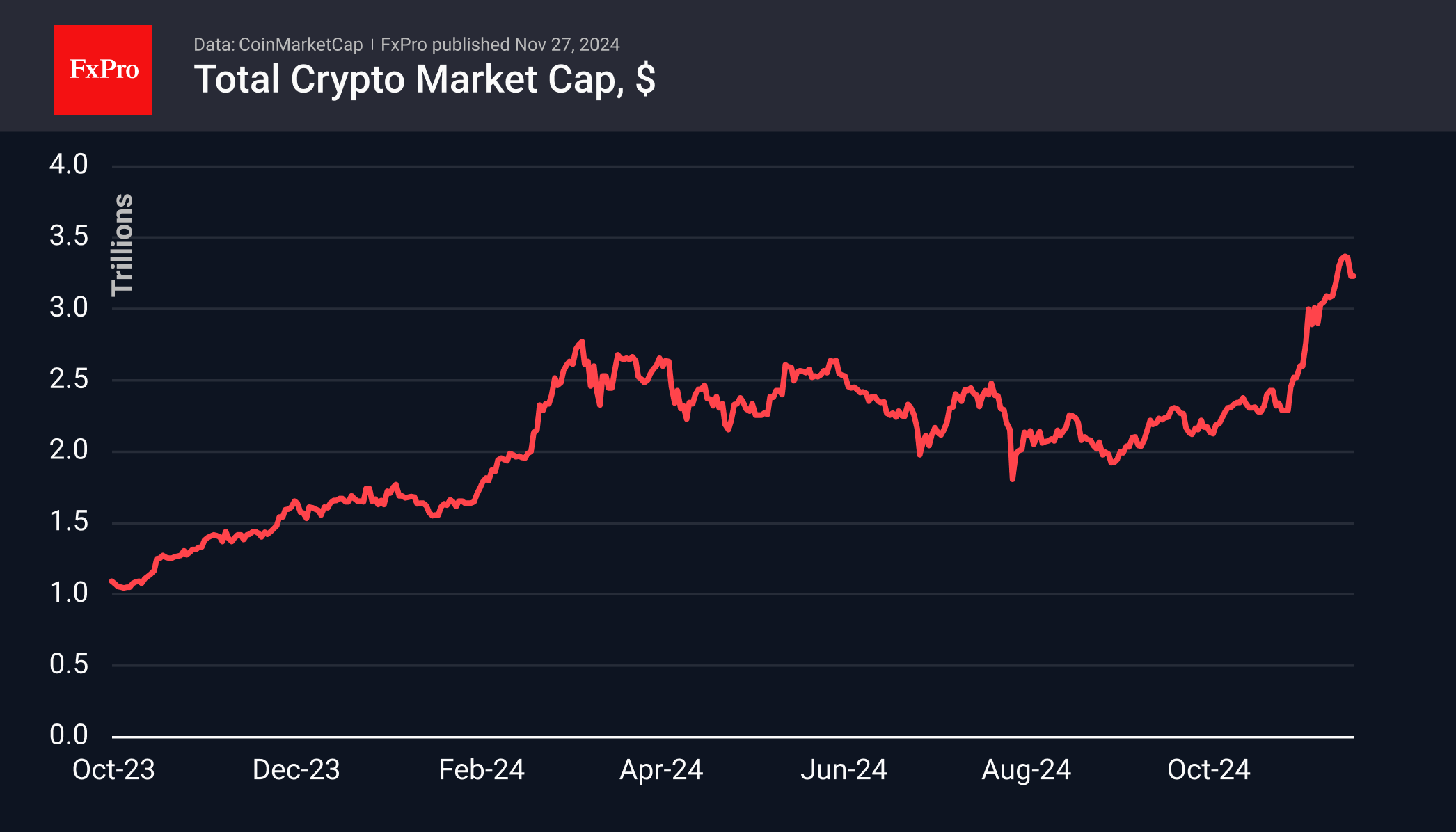

The crypto market dipped to a total cap of $3.15 trillion on Tuesday. However, on Wednesday morning, buying prevailed, pushing the capitalisation back above $3.22 trillion, around the same level as the previous day. The return of buyers is boosting hopes of an end to the correction, fuelled by the overwhelmingly positive momentum in equity markets.

A major driver of the recent correction was Bitcoin, which lost almost 9% from peak to trough. Both profit-taking and the cautious sentiment in global markets drove it down. The impact of both factors may be waning at the 76.4% retracement of the rally from the November lows, a strong level in strong bull markets.

Bitcoin’s recent pullback gave altcoins a chance to catch up. The Altcoin Season Index has risen to 54, a new high for the year and an impressive rise from 27 in the last six days. This is an indirect confirmation that Bitcoin’s recent correction is due to a search for more profitable alternatives rather than a fundamental change in sentiment. As such, we expect the crypto market to return to historic highs soon, with altcoins being the driving force. However, this does not negate the renewal of the highs of the first cryptocurrency.

News Background

Bitcoin’s path to the psychological level of $100K has “stalled” against the backdrop of the liquidation of longs for $430 million and increased concerns about the publication of the Federal Reserve meeting minutes and inflation data, notes CryptoQuant. The situation could be exacerbated by the upcoming US Thanksgiving holiday on 28 November.

According to DeFi Llama, Ethereum has regained dominance of the USDT stablecoin offering after TRON took the lead in August 2022. The ETH blockchain has issued $60.3 billion worth of tokens, compared to nearly $58 billion on its rival’s network.

In November, trading volume on the decentralised exchanges (DEX) on the Solana network reached a record $109.8bn, almost twice as high as Ethereum’s. The previous monthly record was set in March 2023. In both cases, such high levels can be attributed to the hype surrounding meme coins.

Tron founder Justin Sun has become the largest investor in World Liberty Financial, the crypto platform linked to Donald Trump’s family. He bought 2 billion WLFI tokens worth $30 million.

Maya Parbho, a presidential candidate for Suriname, the South American republic, has announced plans to recognise Bitcoin as legal tender and move the country’s financial infrastructure to blockchain.

The FxPro Analyst Team