Market Overview

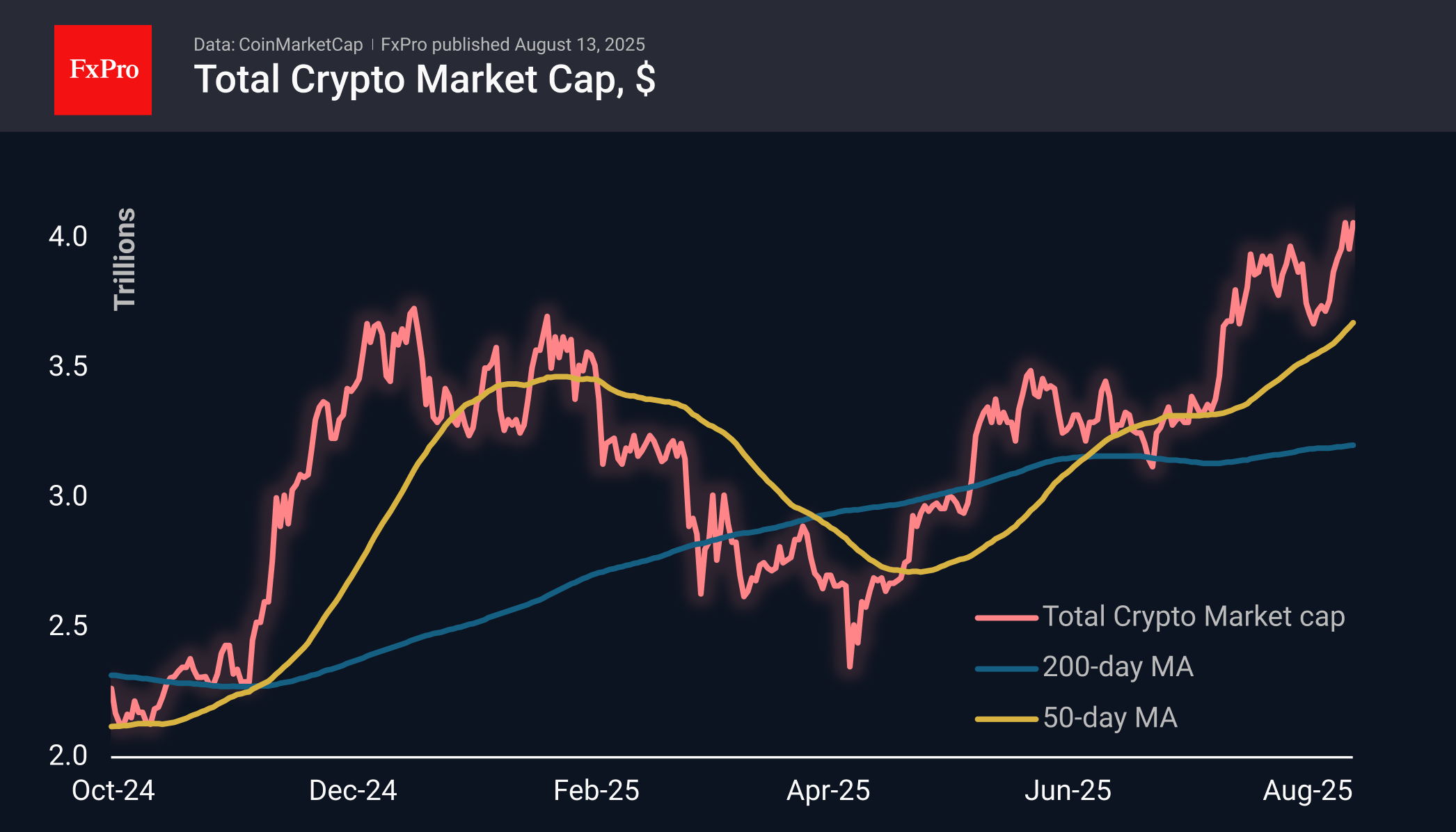

The crypto market has returned to its historical highs, with a cap of nearly $4.05 trillion, reaching a peak of $4.8 trillion. Major altcoins led by Ethereum (+7.5%), Solana (+12%), Cardano (+8.5%), and Chainlink (+9.3%) contributed to the total growth of 2.3% over the past 24 hours.

Bitcoin rose by a modest 0.4% during the day and remains 2% below the levels of 30 days ago — clear evidence of the market’s switch to altcoin-mode. We suspect that investors are selling the first cryptocurrency to finance purchases of altcoins. And it is hardly reasonable to talk about a reversal in sentiment, given the rally in altcoins and the historic highs of the S&P500 and Nikkei225.

Chainlink, the 11th largest coin by market capitalisation, has shown impressive growth recently, gaining about 50% over the past seven days and more than doubling in price from its lows at the end of June. In terms of dynamics over the past few weeks, it is quite competitive with Ethereum. From current levels near $23.3, the bulls’ immediate targets appear to be the 2025 highs around $25, but it will take more than a doubling of the price to break through the historic highs of 2021.

News Background

According to SoSoValue, net inflows into BTC ETFs slowed to $178.2 million on 11 August. Total inflows since the approval of Bitcoin ETFs in January 2024 have reached $54.60 billion.

Inflows into spot Ethereum ETFs in the US jumped to a record $1.02 billion on 11 August. Total net inflows since the ETF’s launch in July 2024 have grown to $10.83 billion. The total assets under management by ETH ETFs rose to $25.71 billion, or 4.77% of Ethereum’s supply.

Mining company BitMine Immersion Technologies (BMNR) announced that it had raised an additional $20 billion to purchase Ethereum. BitMine was the first public company to accumulate more than 1 million ETH.

USDC issuer Circle announced the launch of its own first-level network, Arc, focused on stablecoins. The blockchain will be focused on financial transactions: payments, currency exchange, and capital markets.

The FxPro Analyst Team