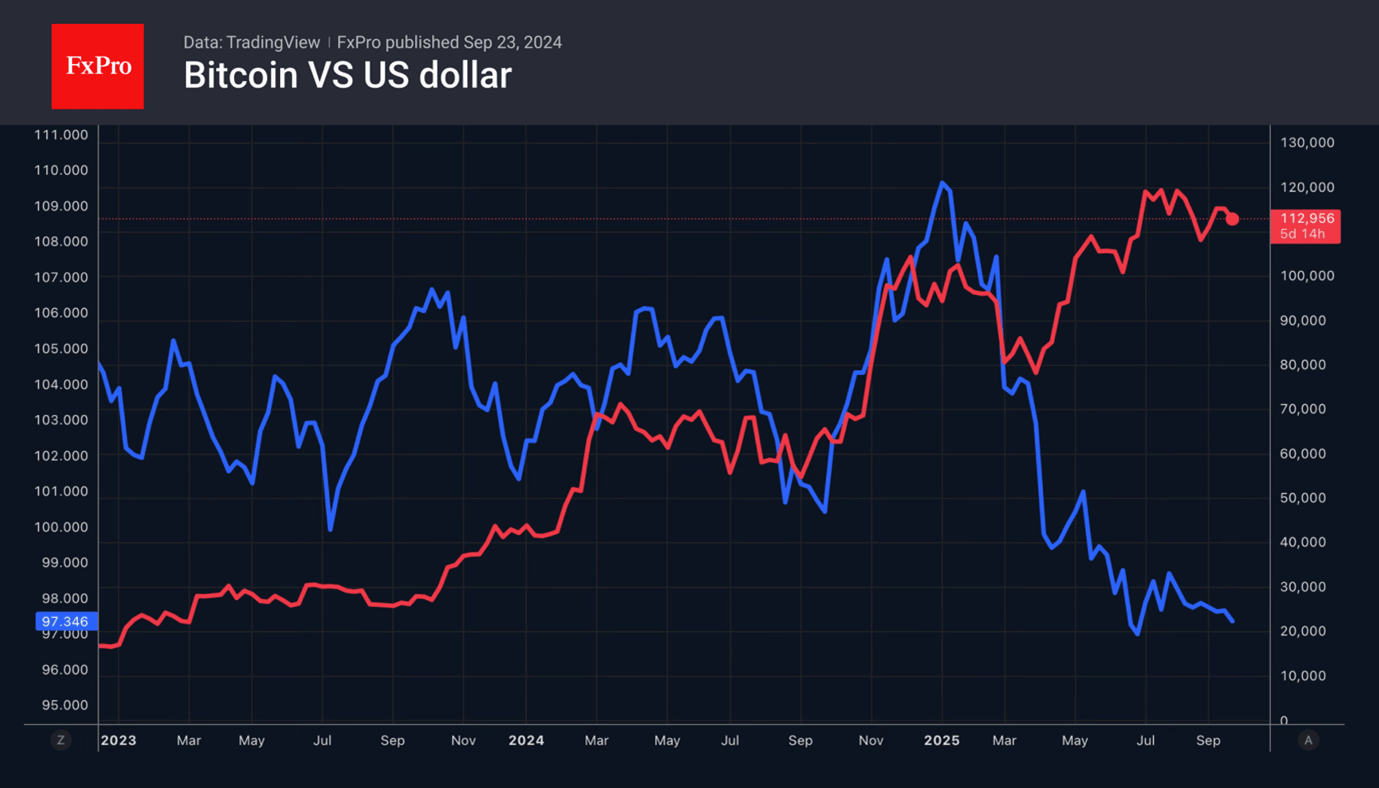

Digital assets have been hit by one of the biggest sell-offs since the beginning of the year. According to Coinglass, 1.5 billion dollars in long positions were liquidated at the start of this week. Bitcoin fell from its monthly highs due to a revision of market views on the fate of the federal funds rate, the strengthening of the US dollar, and concerns about a decline in demand.

Corporations have accumulated $116 billion worth of Bitcoin and have become serious players in the market. The fall in their shares, coupled with Nasdaq’s requirement for shareholder approval of new issues, has created real panic. If these financial institutions find it difficult to raise funds through securities issues, demand for digital assets will fall, and prices will also drop.

Optimists believe that this is not the case. There are also specialised exchange-traded funds and the resumption of the Fed’s monetary policy easing cycle is likely to increase demand for Bitcoin ETFs. The outflow of capital from money market funds will also play a role. Reserves increased to a whopping $7.7 trillion in 2025. The average yield was 4.1%, which is significantly higher than the average 0.6% on bank deposits. As the federal funds rate declines, yields will fall, and money will flow into other ETFs, including those related to cryptocurrency.

Investors believe that over time, the link between US stock indices and Bitcoin will be restored. However, while US stocks have such an important growth driver as artificial intelligence technology, Bitcoin does not. Companies from the S&P 500, especially tech giants, regularly report positive corporate reports. Interest in cryptocurrency purchases by corporations, on the contrary, is falling.

The cryptocurrency market is prone to extremes. The highest derivative bets are concentrated at the 95,000 and 140,000 levels. This means that after a long period of calm, investors are expecting to see a real storm. Much will depend on the ability of Bitcoin bulls to overcome important resistance levels at 113,500 and 115,000. If they succeed, there will be a chance to restore the uptrend. Failure will increase the risks of a Bitcoin correction.

The FxPro Analyst Team