Market Overview

The crypto market capitalisation has increased by 1% over the past 24 hours to $4.06 trillion. The positive momentum was driven by new highs on the Nasdaq100, fuelled by positive corporate news and expectations of a Fed interest rate cut. The latter also pulled the dollar down, raising the market’s overall valuation level.

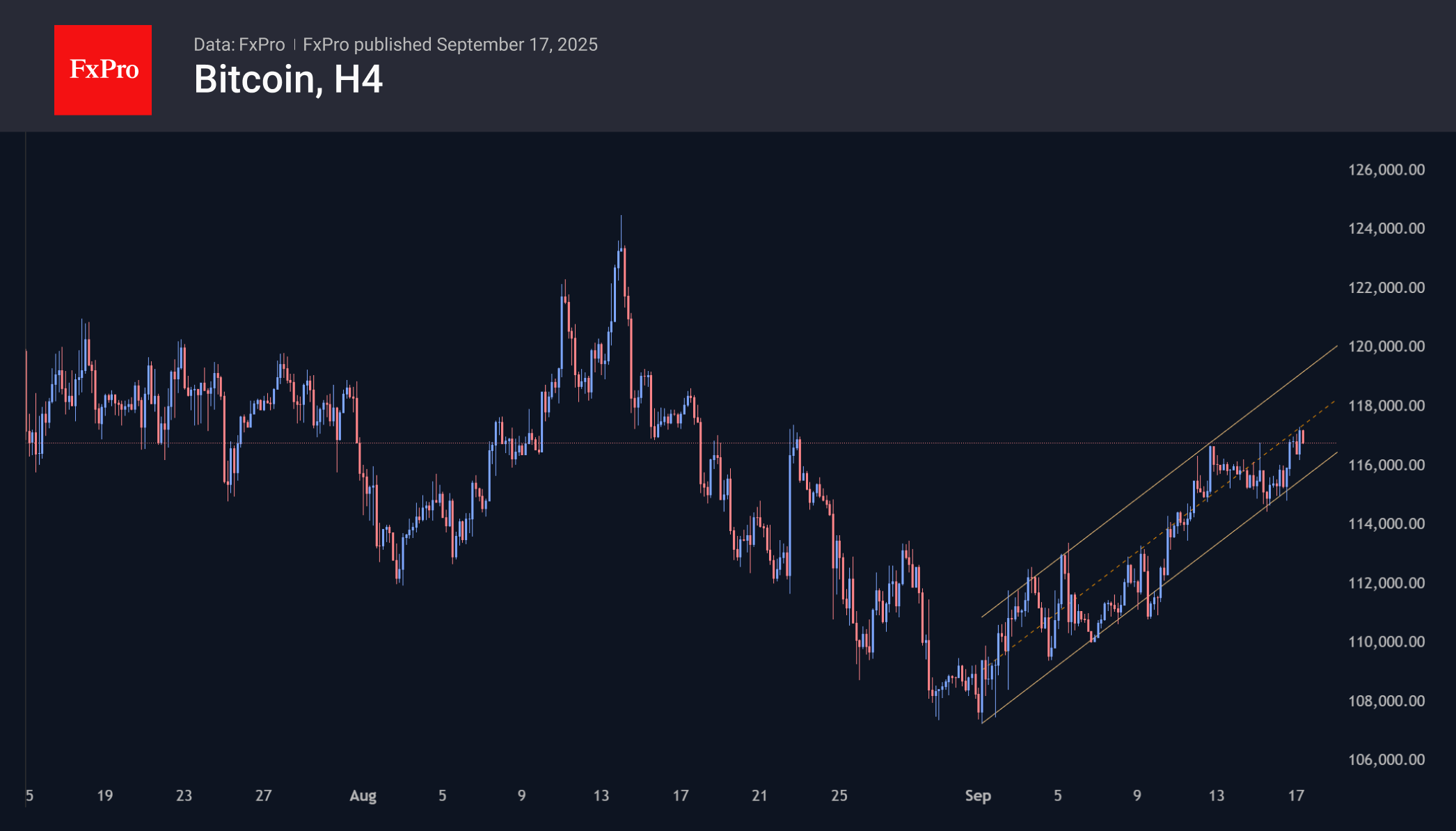

On Wednesday morning, Bitcoin briefly rose above $117K, continuing its upward trend since early September. The upper limit of this corridor is now close to $119K, and growth in this area will return the price to the plateau of the second half of July, which can be considered a springboard for a new test of historical highs.

Binance Coin was one step ahead of BTC, updating its historical highs almost daily since the beginning of last week. In February, March and April, the price found support from buyers on dips to $500. In the following months, there was a rally to $860 at the end of July and a corrective pullback to 61.8% of that growth. The extension of this pattern allows us to consider $1080 as a potential near-term target from the current $955.

News Background

All market attention is focused on the Fed meeting, the results of which will be announced on Wednesday evening. AlphaBTC analysts expect a correction in BTC after the expected cut in the Fed’s key rate.

BitMine CEO Tom Lee expects a ‘grand rally’ for Bitcoin and Ethereum in Q4. This will be facilitated by global easing of central bank policy and seasonal factors.

Payment giant PayPal has launched a P2P service called PayPal Links for sending cryptocurrencies in the PayPal app. Bitcoin, Ethereum, and the stablecoin PYUSD will soon be integrated into it.

Strategy additionally purchased 525 BTC ($60.2 million) last week at an average price of $114,562 per coin, according to company founder Michael Saylor. The company now owns 638,985 BTC, purchased at an average price of $73,913. The total investment is estimated at $47.23 billion.

China’s largest corporate holder of Bitcoin, Next Technology Holding, has announced plans to sell $500 million worth of its shares, including to purchase the first cryptocurrency.

Pantera Capital CEO Dan Morehead said Solana has proven its superiority over Bitcoin in terms of returns over the past four years. The company has invested more than $1.1 billion in SOL — more than in Bitcoin or Ethereum.

The FxPro Analyst Team