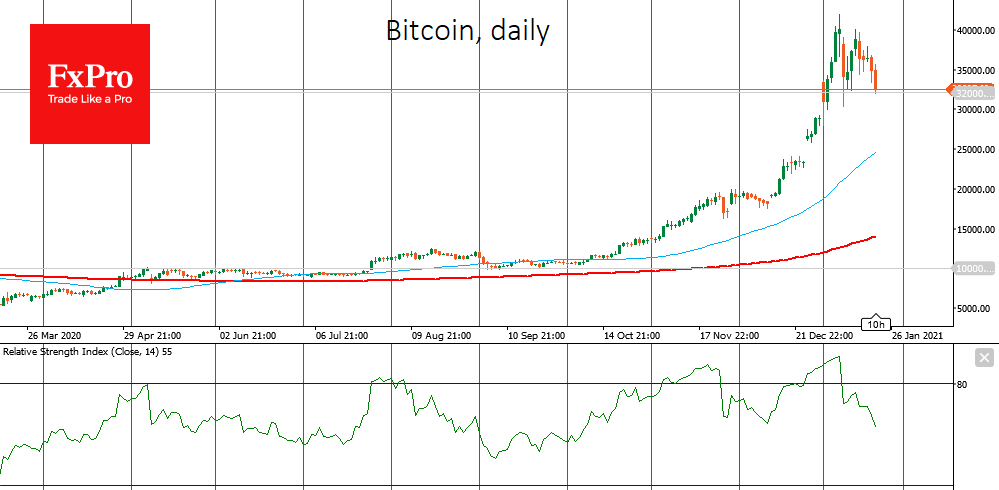

The cryptocurrency market is at a crossroads amid the inauguration of a new U.S. president, the announcement of new stimulus, and rising stocks. Bitcoin continues its cautious decline after a failed attempt to test $40K at the end of the last week. The coin has lost about 4% in the last 24 hours and is changing hands for $33K. There is no panic in the market right now, but it could start if Bitcoin drops below $32K. The depth of the sell-off will also depend on how fast the price falls. If the price shows a slow slide, market participants will still see the likelihood of a bullish comeback. If however, the price decline is sharp and breaks $30K, we may well see a trend reversal and a sharp increase in bearish pressure.

The Crypto Fear & Greed Index continues to decline following bitcoin’s loss of its upward momentum. In the last 24 hours, it has dropped another 3 points to “75”, losing the “extreme” prefix and switching to “greed” mode. The RSI index on the daily charts shows a steady decline away from the overbought zone and is already near the middle of its range.

Bitcoin has gotten its boost impulse from big capital but there is a possibility that smart-money may use Bitcoin and a few major cryptocurrencies as a means to temporarily “park” funds as well as a way to diversify portfolios. The transfer of power in the U.S., the certainty of another stimulus package, and stock impulses may indirectly point to the likelihood of large investors selling off their crypto assets.

Many funds are not required to report on such transactions, while others will do so with a certain time lag. Others may sell their assets on over-the-counter exchanges. Nevertheless, coins can change hands, and technical indicators are already pointing to a cooling of the previously overheated market. The key question is whether there will be enough bulls in the market who think Bitcoin price levels around $30K are good for opening positions “with a discount”, as that is the impulse needed now to give crypto market participants hope for a return to growth.

All altcoins duplicate the dynamics of Bitcoin, and unlike early 2018, when capital followed the hype around the benchmark cryptocurrency and headed towards altcoins, it will now be much harder to convince retail investors that alternative cryptocurrencies can act for a long time in isolation from the dynamics of the first cryptocurrency.

The FxPro Analyst Team