Market picture

The crypto market has lost 1.5% over the past 24 hours, to $1.39 trillion. The sustained pressure has been in place since the start of the day on Thursday and looks like profit-taking from the impressive rally since the middle of last month. The correction is not as deep as it could have been, as it is primarily offset by demand for risk assets.

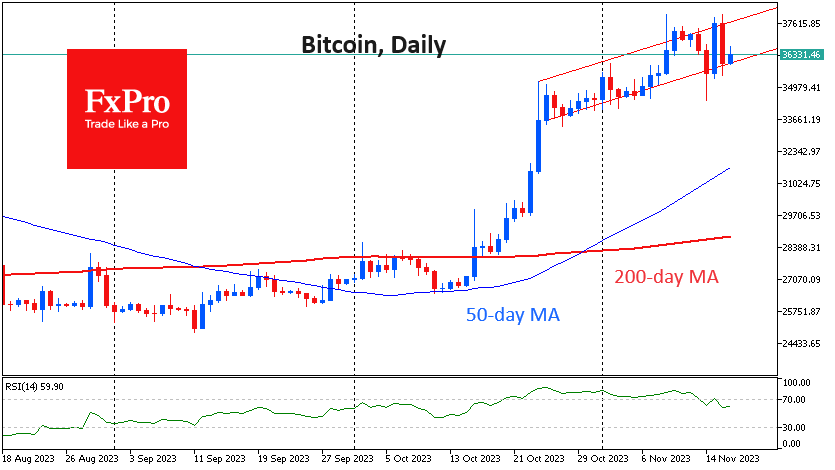

Tactically, we focus on the increased volatility of Bitcoin, which has fallen below 34500 since the beginning of the week, then rebounded sharply to 38000 and is trading near the midpoint of that range at 36500 at midday on Friday. Despite the volatility, bitcoin has remained in an uptrend since late October, while the volatility is clearing overbought conditions and making room for further gains.

News background

The SEC delayed a decision on Hashdex’s application to launch a spot ETF based on digital gold until 1 January 2024. At the same time, the SEC also postponed a decision on Grayscale’s application to launch an ETF based on Ethereum futures.

According to Bloomberg Intelligence, Grayscale’s application to launch ETFs based on Ethereum ETH futures is needed to advance the decision to launch spot funds on the second cryptocurrency.

SkyBridge Capital CEO Anthony Scaramucci said the Fed’s rate cut early next year will lead to another bull cycle in the cryptocurrency and equity markets. In addition, approving spot Bitcoin ETFs and halving BTC will create a “huge demand” for Bitcoin.

Tether, which issues the most popular stablecoin USDT, plans to invest $500 million in bitcoin mining over the next six months.

US presidential candidate Vivek Ramaswamy pledged to support bitcoin, cryptocurrencies, and decentralised finance (DeFi) in every way possible if he wins the presidential election.

The FxPro Analyst Team