Market Picture

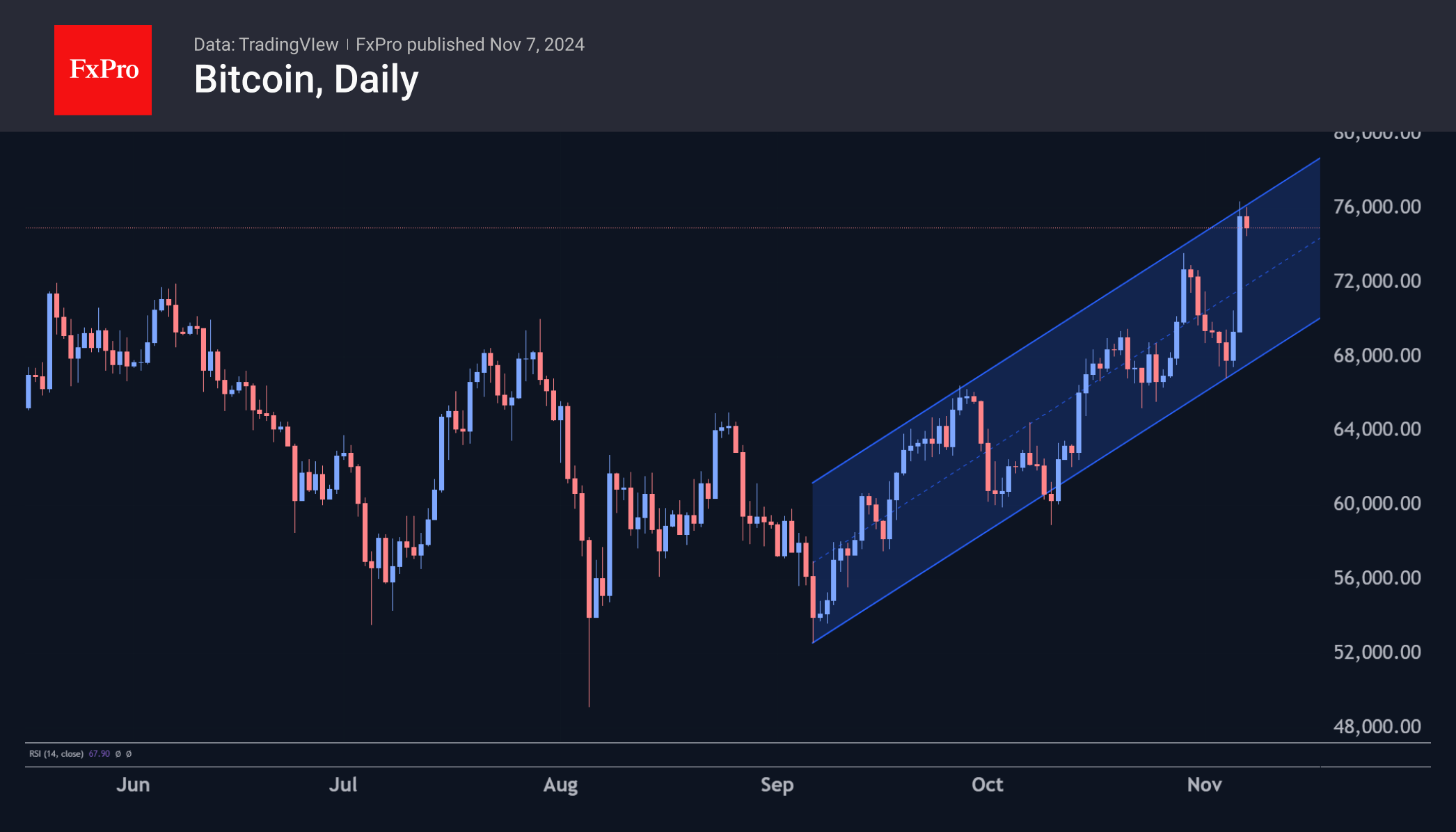

In the cryptocurrency market, bitcoin has hit all-time highs, rising above $76K at one point on Wednesday. The increase over Tuesday and Wednesday was an impressive 14% but is well within the upward trend established in early September, although we did see a very rapid rise from the lower end of the range to the upper end.

Given the latest technical breakout, the working scenario looks like a rise to $100K in the two to three-month timeframe. A more moderate pattern suggests staying inside the formed range, within which the chances of a pullback to $70K are higher in the short term.

News Background

Many crypto industry participants believe Trump’s victory will be a catalyst for the development of the country’s digital asset sector. In addition to a change in leadership at the SEC and a review of the regulator’s enforcement practices, the industry also expects to see an increase in the number of cryptocurrency ETFs.

Bernstein expects clarity on the classification of crypto assets and faster progress in passing legislation on stablecoins and the structure of the whole crypto market.

Trump’s victory sent cryptocurrency stocks up more than 10% on Wednesday. Miners also strengthened their positions. Shares of Elon Musk’s Tesla jumped almost 15%.

Bitcoin’s price surge above $75K makes its market cap bigger than that of US fintech giant Meta. The first cryptocurrency climbed to ninth place on the list of biggest assets by capitalisation.

Ethereum’s capitalisation to bitcoin ratio fell to 24.5%, its lowest level since April 2021. At the beginning of 2024, the ratio was 32.7%. The indicator reflects investor preferences and capital flows between the two largest cryptocurrencies.

The FxPro Analyst Team