Market Picture

Crypto market capitalisation is up 0.85% in the last 24 hours to 1.21 trillion, in the middle of its range over the previous two weeks. The Crypto Fear and Greed Index rose 5 points to 64, establishing itself in greed territory and showing that sentiment is recovering faster than capitalisation.

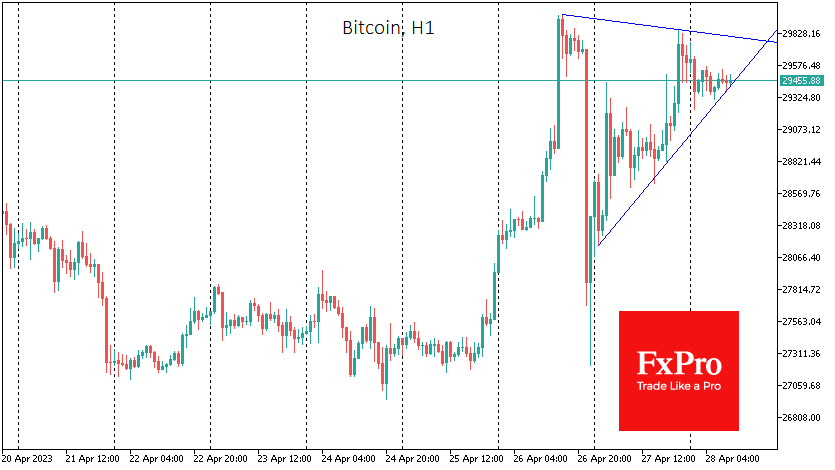

Bitcoin attempted to approach $30K again on Thursday but hit lower highs than on Wednesday, although it didn’t pull back as hard. Notably, the Nasdaq high tech index was up an impressive 2.75%.

Bitcoin continues to form triangles in the short term and has a reasonably clear support line. At the same time, an impressive supply of sellers is preventing the price from fixing above the psychologically important $30K price.

Kaiko points to the increasing correlation between BTC and gold. The cryptocurrency’s dependence on precious metals has grown since early March. The banking crisis and the risks of financial turmoil are scaring investors around the world and causing them to buy up safe-haven assets.

According to CryptoQuant, bitcoin’s leverage ratio has reached an all-time low of 0.195. This reduces the volatility of the spot VC market, which is becoming less sensitive to futures market activity.

News background

Ethereum options volume and open interest on the CME hit all-time highs following the successful Shapella hardfork.

The Hong Kong Securities and Futures Commission (SFC) said it is preparing rules for licensing crypto exchanges and will introduce them next month. Turning Hong Kong into a crypto hub could provide liquidity for cryptocurrency growth and become a new rally driver, according to Blockfin Academy.

Investment in bitcoin startups has outpaced the rest of the crypto industry in terms of investment in 2022, according to a report by Trammell Venture Partners (TVP). However, the first cryptocurrency has yet to be widely accepted.

The Google Cloud platform has partnered with the Polygon project to accelerate the adoption of “key Polygon protocols” in enterprise infrastructure and tools and “increase bandwidth” in gaming, supply chain and DeFi.

The FxPro Analyst Team