Market picture

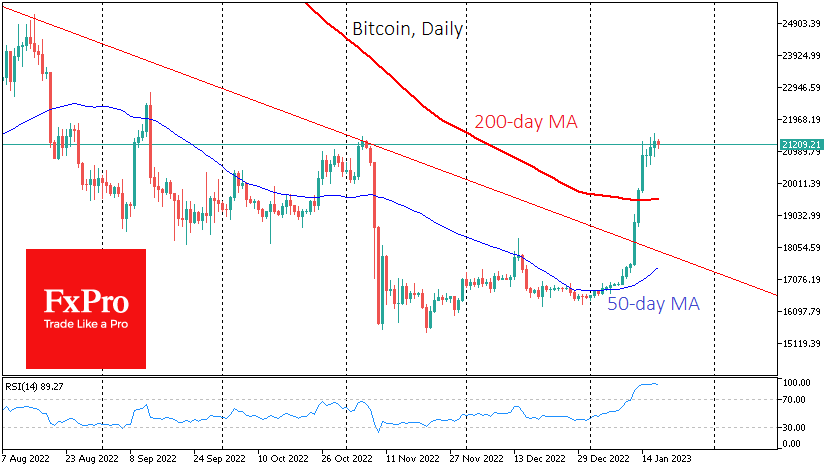

Bitcoin continues its streak of small wins, recording its 13th consecutive day of gains on Tuesday, adding for 15 days in the last 16 sessions this year. The exchange rate rewrote a two-month high at $21.55K. Local overbought conditions continue to build, with help from the stock indices, where the Nasdaq100 managed to close Tuesday’s trading higher.

Bloomberg strategist Mike McGlone said that the bottom in the crypto market has already been passed. He noted that the charts resembled the situation in 2018, although the macroeconomic situation is quite different. Back then, the Fed had already started easing its policy, but now it is a long way off, “so anything can happen”.

It is easy to agree with this statement, but we still point out that growth is vulnerable to sharp declines at this stage. From a long-term investor perspective, we pointed out already in November that the crypto market has passed its low point. However, the best time for speculative buying is yet to come, when there will be a FOMO stage, like we last saw from December 2020 to April 2021. An even more colourful rise was from April to December 2017. In both cases, an acceleration and near-ubiquitous rise after surpassing previous historical highs.

News background

Digital currencies, CBDCs and stablecoins are the natural evolution of money and payments and will fundamentally change the global financial system, Bank of America believes. CBDCs “may become the most significant technological advance in the history of money”.

According to a new analysis by mining company Luxor, Bitcoin is showing “resilience” amid the challenges it has faced in the past year. Macroeconomic pressures, natural anomalies, and the high volatility of some mining companies’ shares (and, in some cases, their bankruptcy) have never been able to prevent the network’s hash rate from rising significantly. The European Parliament has changed the timetable for the European Union’s Cryptocurrency Regulation Act (MiCA). Its final consideration has been pushed back to April. The 400-page document needs to be translated into 24 EU languages.

The FxPro Analyst Team