Market Picture

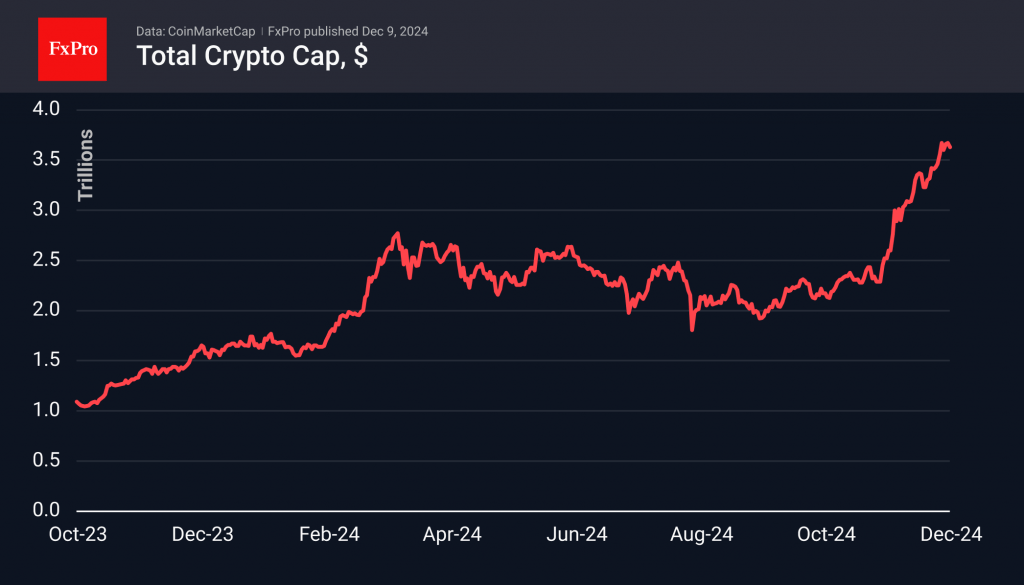

The cryptocurrency market corrected 1.2% in 24 hours, but the 5% gain for the week still indicates a strong bull market despite more frequent mini-corrections. Bitcoin is failing to consolidate above $100K, which is likely suppressing buying in the overall cryptocurrency market.

Bitcoin is trading just below $99K with minimal overnight movement. Its inability to grow has negatively impacted altcoins. We view Bitcoin’s lull as an important position correction that will help the market shake off short-term overbought conditions and move more reliably higher. The next upside momentum could take the price to the $120K area, working off the Fibonacci extension.

Ethereum loses 2%, also failing to consolidate above $4000 and falling just a few dollars short of updating the year’s highs. The coin doesn’t see meaningful support until the $3700-3800 area.

News Background

According to SoSoValue, net inflows into spot bitcoin ETFs in the U.S. totalled $2.73 billion last week, following outflows of $138.1 million the previous week. Cumulative inflows since bitcoin ETFs were approved in January rose to $33.43 billion.

Net inflows into the Ethereum ETF rose to a record $836.7 million last week after inflows of $446.5 million the previous week. Cumulative net inflows since the ETF’s launch in July rose 2.5 times to $1.41 billion for the week.

BlackRock and MARA Holdings bought 7,750 BTC and 1,423 BTC, respectively, as the former cryptocurrency’s price fell to $90,500.

Former US Treasury Secretary Lawrence Summers called Trump’s plan to create a strategic reserve in bitcoins “insane.” In his view, the only reason for such a move is “to coddle generous campaign donors.”

The SEC has notified at least two of the five issuers of spot Solana ETFs that it will reject their Forms 19b-4. The commission plans to consider new cryptocurrency ETFs once the agency’s leadership changes.

The FxPro Analyst Team