Market picture

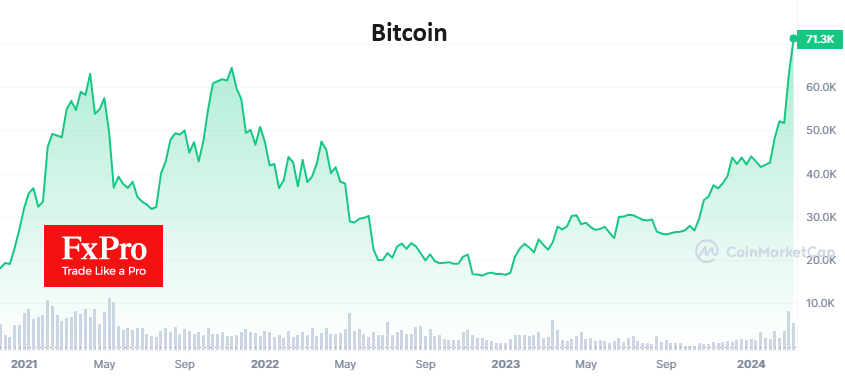

Bitcoin’s record highs support the accelerated recovery of the crypto market. Its capitalisation reached $2.69 trillion (+1.6% in 24 hours), 10% below the record high of $2.97 trillion in November 2021. Extreme greed remains the driver of the crypto market, but major coins are getting the main influx of money.

Bitcoin hit an all-time high of $71.5K early Monday afternoon, adding 2.5% in 24 hours. Ethereum is rising with the market, adding 1.4% in the same time frame and breaking the $4000 price.

The surge in trading activity has helped to revitalise BNB, which is adding over 4% for the day. It has gained 25% in 7 days, twice that of Ethereum and three times ahead of Bitcoin during this interval. However, like Ether, it is about 15% away from the record highs of late 2021.

News background

BlackRock’s spot BTC-ETF iShares Bitcoin Trust (IBIT) managed to accumulate almost 200,000 bitcoins in two months, becoming one of the largest holders of BTC in the world and surpassing MicroStrategy, which has 193,000 BTC on its balance sheet.

According to The Block, investors have built up a substantial volume of open positions with an expiry price of $70K on Bitcoin call options redeemable on 29 March. Bets on BTC rising to $80K over the next three weeks have also increased.

According to Bloomberg data, bitcoin miners set a monthly record for energy consumption. They consumed a record 19.6 GW of electricity in February, up from 12.1 GW in the same period a year earlier. The rise in BTC has prompted mining companies to spend more than $1bn on new equipment over the year.

A US federal appeals court has resumed hearings on a lawsuit filed by a group of investors against Binance. The investors accuse the trading platform of violating US securities laws by selling unregistered tokens.

Billionaire Mark Cuban said he has always invested in Bitcoin because of its limited supply, which could be the driver of the first cryptocurrency’s bull rally. He believes demand for BTC will outstrip supply as more and more people buy bitcoin and fewer sell.

The FxPro Analyst Team