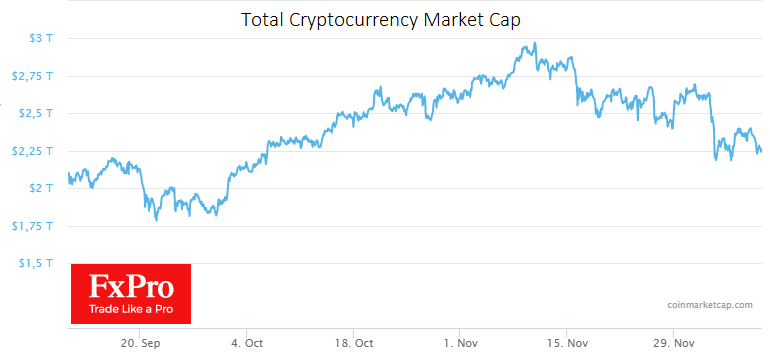

The crypto market has lost 4.2% of its capitalisation in the past 24 hours and now stands at $2.27 trillion. From the peak levels reached a month ago, capitalisation has dropped by 23%, allowing us to speak of the start of a bear market for the sector, at least like the one we saw in April-July.

The cryptocurrency fear and greed index dropped from 29 to 24, slipping into the extreme fear territory.

Alarmingly, the overall capitalisation this time was pulled down by altcoins. The first cryptocurrency lost around 3% over the day, returning to $48.3, where the 200-day moving average runs and touched the oversold area again.

A significant short-term indicator for the market promises to be the 200-day average for Bitcoin. An ability to bounce back above that line would indicate bullish sentiment prevails and promises new attempts to climb above $50K or $60K this month. A sharp fall would formally clear the way for a deeper correction to $41K or even $30K.

ETHUSD has been losing 6% over the last 24 hours and is dangerously close to the psychologically significant $4000 level. The latest momentum of the decline pushed the first altcoin away from the 50-day moving average, and a deeper correction may follow. Ether fell out of the bullish uptrend from the end of September and went into a prolonged consolidation. The declines yesterday and this morning brought the coin back to the lower end of the consolidation range, and a dip under $4000 would open a straight road down with a potential target at $3300 or further to $2700.

Bitcoin’s share of the crypto market has started to rise again, reaching 40.3%. We see this growth in a falling market as an additional sign of fear of the crypto market.

The FxPro Analyst Team