Market picture

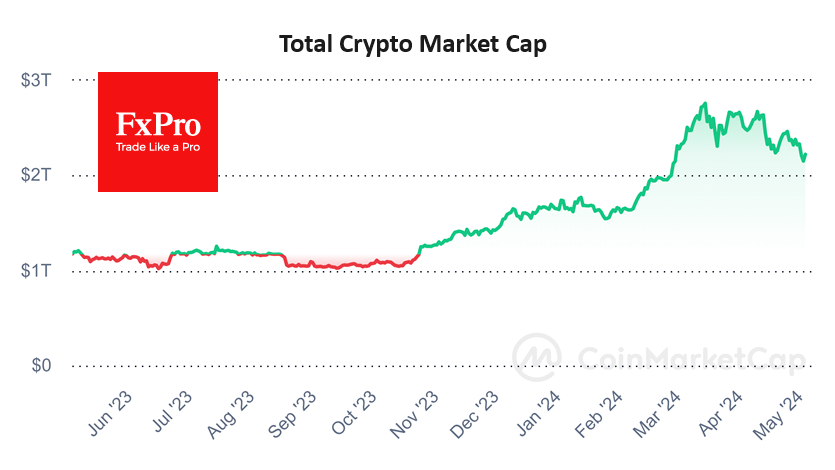

Crypto market capitalisation rose 3.3% in 24 hours to $2.22 trillion. Local capitalisation bottomed near $2.10 trillion, confirming a sequence of declining local lows (2.3 in March, 2.25 in April) and highs (2.76 in mid-March, 2.67 in early April and 2.46 in late April).

Ethereum and Solana are adding from the area of the April lows and forming a double bottom. This is a positive but not too reliable signal, as Bitcoin has been in a downtrend throughout April.

After the halving, it is logical to expect miners to increase sales from inventory, to invest in new capacity or to lock in profits. Also, the hype around spot Bitcoin ETFs is going away, which reinforces selling by speculators.

Assuming Bitcoin stays within the global growth cycle starting in 2023, we should expect further price declines in the coming weeks. The nearest likely target looks to be the $51-52K area, where growth was paused in February and where the 200-day MA will be pulled up by the end of the month.

News background

SoSoValue notes that outflows for $563.8 million from spot bitcoin-ETFs on 1st May reached their highest since product approval. Bloomberg noted the formation of IBIT and FBTC price discounts relative to net asset value (NAV).

BlackRock believes that financial institutions, including pension, endowment, and sovereign wealth funds, will enter the ETF market in the coming months.

VanEck calculated that the aggregate value of Bitcoin in the wallets of governments and companies is $175bn. That’s about 15% of the total BTC capitalisation.

Bitfinex said that Bitcoin options traders are preparing for a summer lull in the market. Summer is usually a period of low volatility in the crypto market. Cube.Exchange, on the other hand, pointed to the likelihood of increased price fluctuations in the summer against a background of low liquidity.

Toncoin (TON) resumed growth after a correction amid an investment from venture capital firm Pantera Capital with over $5bn in assets under management. ‘We believe TON has the potential to bring crypto to the masses as it is widely used in the Telegram ecosystem’, Pantera noted.

On 2nd May, TON developers announced the platform’s integration with the on-chain analytics service Arkham Intelligence. On 1st May, integration with the cross-chain platform Layerswap was implemented, which, according to its representative, will make it possible ‘to send USDC from any network and receive USDT on the TON blockchain’.

The FxPro Analyst Team