Market Picture

Bitcoin has gained 2.6% over the past 24 hours to $28.3K. Meanwhile, demand for other cryptocurrencies was revived as the total crypto market capitalisation rose 3.4% to $1.18 trillion. Ethereum gained 4% overnight, reaching $1800.

Crypto Fear and Greed Index reached 68 (Greed), its highest level since November 2021.

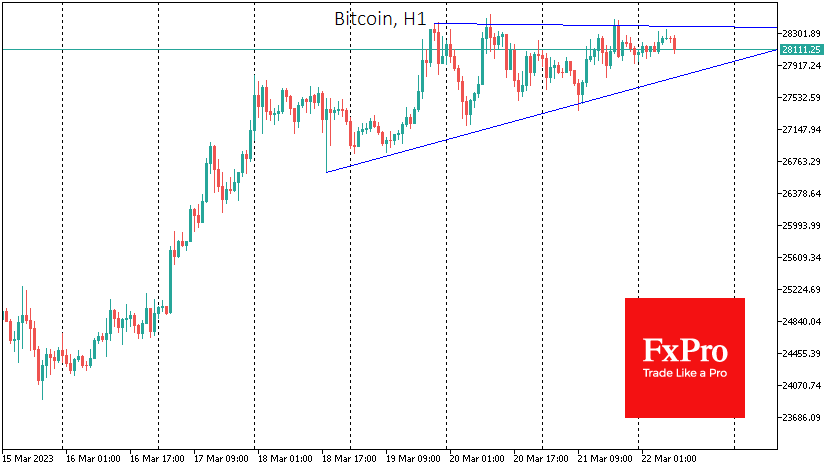

A series of higher local lows is forming on the intraday charts of bitcoin, indicating players’ interest in buying on dips. At the same time, local resistance is almost horizontal.

From a tactical perspective, a break above $28.5K could have a dam-breaking effect and quickly take the price to $30K. A break below $27.5K would negate the bullish technical signal and open the way for a deeper correction.

This is likely to be resolved later this evening after the Fed decision. The reaction of all markets could be vital as the range of expectations is incredibly wide.

News Background

The turmoil in the banking system has led to a shift in investors’ perception of safe haven assets. According to Caitlin Long, CEO of Custodia, more and more market participants see bitcoin as such.

Mastercard, a payment giant, has partnered with the Australian stablecoin platform Stables. The partnership will see the issuance of a card that allows direct payment with stablecoins.

Tron founder Justin Sun is willing to pay $1.5 billion for Credit Suisse, one of Europe’s largest investment banks, to “integrate it into the Web3 world”.

The FxPro Analyst Team