Market Picture

The cryptocurrency market was falling to a total capitalisation of $2.2 trillion at the end of the day on Monday but managed to add over 2% to the lows, recovering to $2.25 trillion, down 0.5% from the day before.

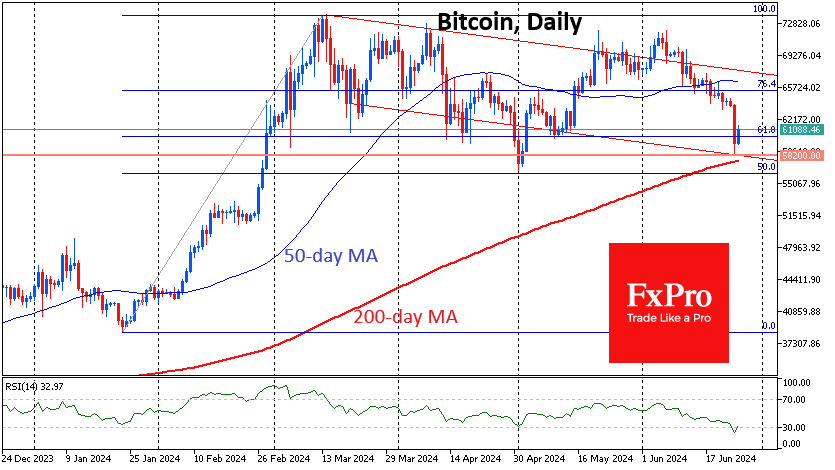

The technical picture in Bitcoin is almost perfect. The low price of $58.2K coincided with the lower boundary of the descending range, was as close to the 200-day moving average as possible, and almost duplicated the impulsive lows of early May. On the daily charts on Monday, BTC closed in the oversold RSI area, and today, it is already trying to get out of it. All this looks like a tempting signal to buy this dip. However, it may well turn out to be a bull trap, although we give less priority to such a scenario.

Bitcoin’s share of the total crypto market capitalisation is near 54%. Since March, there has been an acceleration in the decline of the share of “other” coins, as buyers’ interest has focused on the leading coins. Such dynamics are typical signs of the first half of the 4-year cycle in Bitcoin, and sustained interest in altcoins may not come until next year.

News background

Bitcoin fell below $60,000 amid news of the Mt.Gox payout. The trustee of the bankrupt 2014 exchange, Mt.Gox, announced plans to begin paying out compensation in Bitcoin, Bitcoin Cash and cash in early July. Mt.Gox is expected to distribute more than $9 billion in assets by 31 October 2024.

According to CoinShares, investments in crypto funds fell by $584 million last week after an outflow of $600 million a week earlier; the two-week decline came after five weeks of inflows. Bitcoin investments were down $630 million; Ethereum was down $58 million.

According to Deribit, the options market has been betting on Ethereum, which will rise to $4,000 by September.

Block CEO Jack Dorsey said he sees Bitcoin not just as a currency but as the dominant global reserve asset that could topple the U.S. dollar.

Cryptocurrency and NFT holders in The Open Network (TON) ecosystem have faced massive phishing attacks to steal assets. Malicious links and malicious bots are being spread in Telegram groups, particularly under the guise of airdrop announcements.

The FxPro Analyst Team