Market Overview

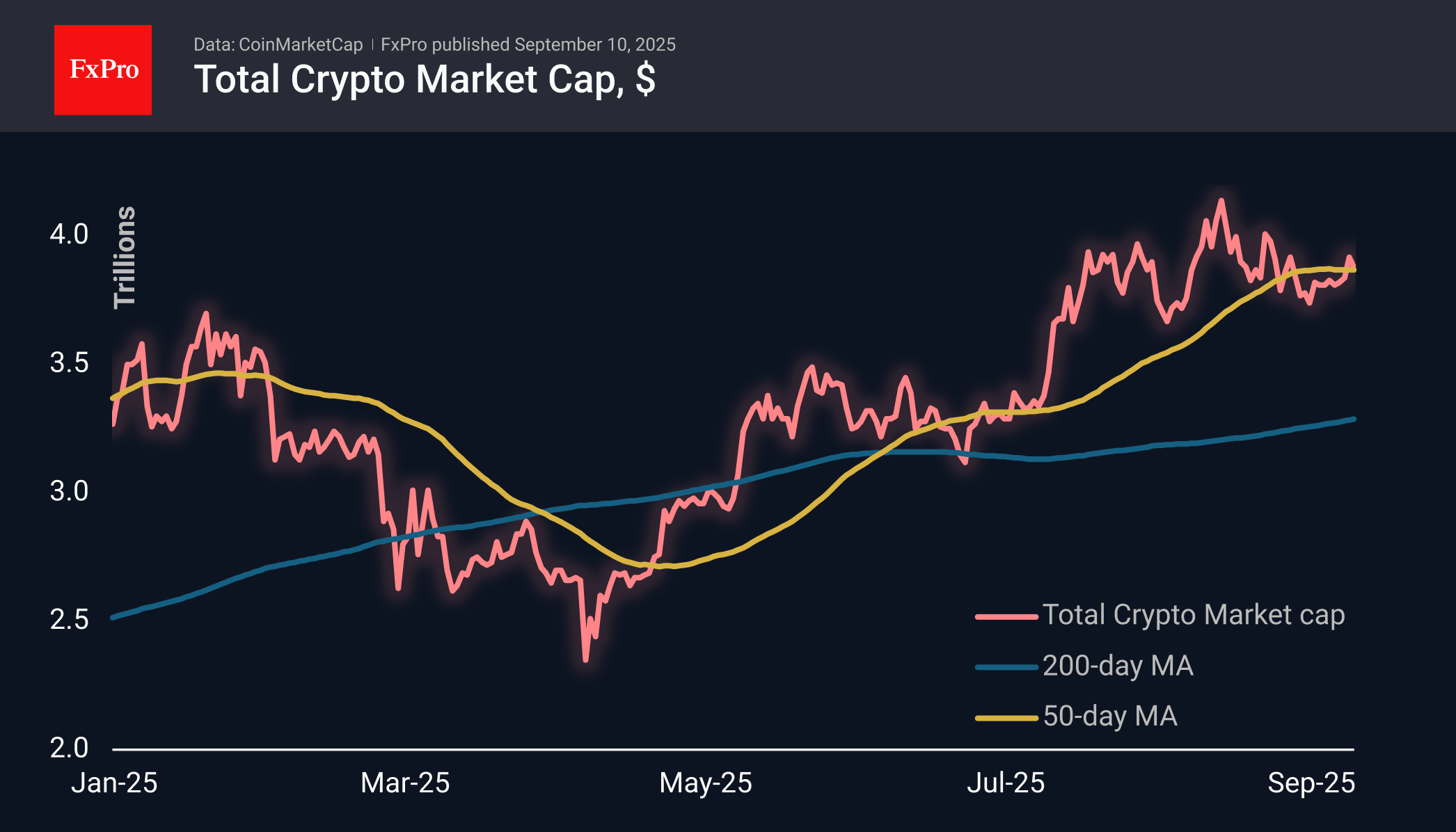

On Wednesday, the crypto market capitalisation hovered around $3.9 trillion, having corrected slightly from its peak the day before. Among the top coins, declines prevailed over the past day, with the exceptions of Solana (+1%) and Avalanche (+3%).

Bitcoin continues to attract buyers on intraday dips, forming a smooth and rather fragile uptrend, shifting the main battle between bulls and bears to the $112K level against $111K a few days earlier. Still, the real test for the bulls looks to be the $115K level, just above the 50-day moving average. The ability to stay above it will be an important signal of a return to optimism, but for now, we can only note BTC’s alarming lag behind stock indices, which are at their highs.

News Background

Bitcoin and cryptocurrencies are awaiting US inflation data, which will be released on Wednesday and Thursday. If inflation continues to rise, markets may reconsider their positions in risky assets, including cryptocurrencies.

In the options sector, there is increased demand for protective instruments, indicating a growing appetite for neutral-bearish strategies. Bitcoin has not yet managed to repeat the records set by the S&P 500 and gold, despite growing expectations of monetary policy easing by the Fed at its meeting next week.

Strategy additionally purchased 1,955 BTC ($217.4 million) last week at an average price of $111,196 per coin, company founder Michael Saylor said. The company now owns 638,460 BTC, purchased at an average price of $73,880. The total investment is estimated at $47.17 billion.

The US Congress has prepared a bill instructing the Treasury Department to study and prepare a report on the economic and technical aspects of the country’s strategic bitcoin reserve (SBR).

Analysts predict Solana will grow to $300 amid an increase in the ecosystem’s total value locked (TVL). The indicator reached a record $12.2 billion, which is 57% higher than June’s figures. Against this backdrop, activity in the meme coin segment is growing — over the past three months, its total capitalisation has increased by 70%.

The FxPro Analyst Team