Market picture

The crypto market cap has stabilised at $2.6 trillion after an impressive surge following the Ethereum rally. Among the top coins over 24 hours, Toncoin is leading the decline, falling 5%, while Dogecoin is leading the way with a 3.4% increase.

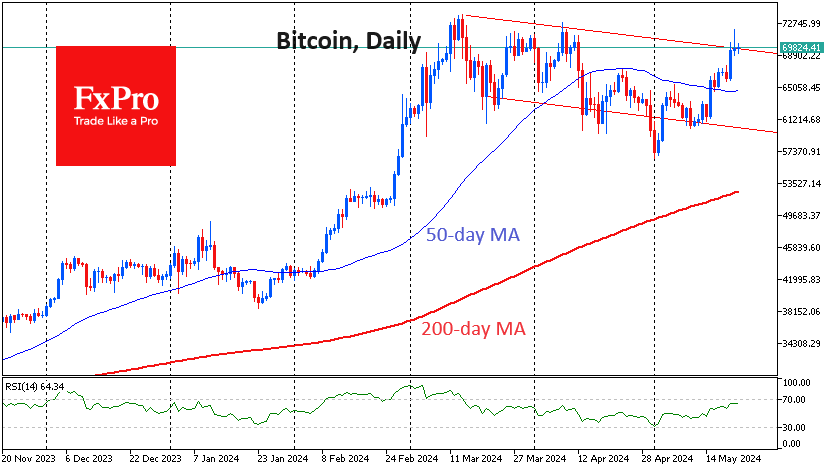

Bitcoin is losing 1.9% in 24 hours to just below $70K, having come under pressure after it rallied above $71.3K, as short-term speculators rush to take profits around the all-time highs reached in March. The local highs are just below the peaks in April and March, and now all eyes are on the market’s next move. A break of resistance at $72K has the potential to trigger a real FOMO. A pullback below would force a $60K correction scenario to be considered as the main one.

Ethereum has rallied around 22% since Monday evening, surpassing $3800. Technically, we got a signal of a powerful spurt above the 50-day moving average, meaning a return to the bull trend. Short-term, Ethereum has a clear path to $4000, the March peak, after which the bulls can target $4600. Now is the time when Bitcoin’s next move depends on Ethereum.

News background

According to media reports, the US SEC has asked companies to update Form 19b-4 in applications to launch a spot Ethereum-ETF. Bloomberg raised the odds of spot Ethereum-ETF approval from 25% to 75% following the news.

Management company Fidelity removed the steering clause in its updated Form S-1 application for a spot Ethereum-ETF. Galaxy Research believes that staking is the main stumbling block to launching an Ethereum-ETF in the US.

Standard Chartered expects the Ethereum-ETF to be approved as early as this week. The deadline for applications from VanEck and Grayscale is 23 May.

However, the SEC’s action does not mean that spot ETH-ETFs will necessarily be approved in May. Potential issuers need to approve a Form S-1 before launching the instrument.

Telegram’s crypto ‘Wallet’ has opened a P2P auction for the NOT, a token of the Web3 gaming project Notcoin. Users will be able to buy and sell coins in Telegram using more than 290 supported payment methods.

The FxPro Analyst Team