Market picture

Bitcoin fell on Thursday by the most in 3.5 weeks amid a sharp decline in stock indices and a stronger US dollar. BTC rolled back to $17.4K, losing 1.3% overnight. Ethereum, which trades at $1270, shows the same decline amplitude. Total crypto market capitalisation is down 0.7% to $852bn. The pressure on cryptocurrencies came from the stock market, so assets with more institutions are faring worse than others.

The Cryptocurrency Fear and Greed Index was down 2 points by Friday, to 29 and continues to be in a state of “fear”.

From a tech analysis perspective, Bitcoin has failed to latch on to levels above the 50-day moving average, causing it to now face speculative pressure. However, this kind of pressure usually lasts for a day or two unless backed by external reasons.

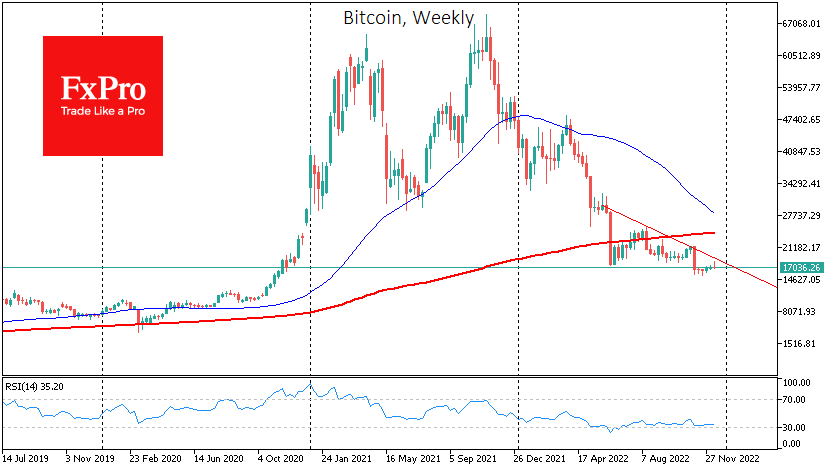

On the higher – weekly – timeframe, one can see the development of the current downward phase since the end of May. The RSI would form a bullish divergence, as new price lows correspond to higher levels in the index. This could signal exhaustion for the sellers or consolidation before the next leg down.

News background

Cryptocurrency exchange Binance has enough liquidity to allow all customers to withdraw 100% of their assets, if necessary, said Changpeng Zhao, head of the company. However, he said 99% of users need to gain the knowledge to hold cryptocurrencies on their own and, therefore, could lose their assets.

The collapse of FTX caused fewer losses than the bankruptcy of the Terra ecosystem before it, Chainalysis claims. That said, estimates of realised losses may be overstated, as any move from one wallet to another was considered a selling event.

ConsenSys, the company behind the popular cryptocurrency wallet MetaMask, announced a partnership with payments firm PayPal where users can buy Ethereum.

The FxPro Analyst Team