Bitcoin has suffered from the former institutional love affair with it. On Monday, a significant sell-off in the stock and bond market prevented the first cryptocurrency from returning to the upside. The recent sell-off confirmed a bearish scenario for bitcoin for now. And one should watch closely to see if this situation becomes toxic for the entire cryptocurrency market.

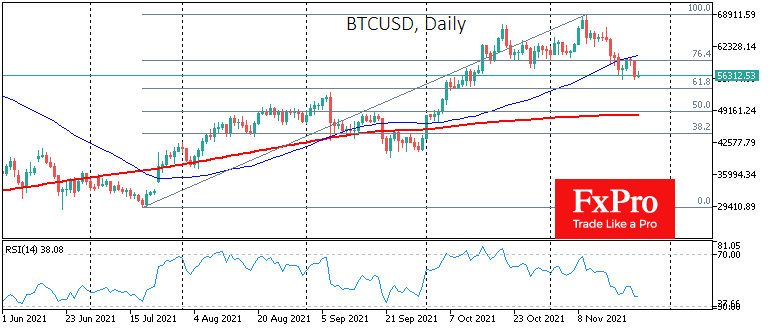

Bitcoin fluctuated widely on Monday, and at some point, it managed to recover an initially weak start. But pressure on equities in the US trading session and the ongoing strengthening of the dollar dragged crypto down. From intraday highs, bitcoin lost 6.3% by the end of the day, at one point falling to $55.6K.

The bears showed who is in control now, clearly demonstrating that bounce attempts are stumbling into aggressive selling. In such an environment, it should come as no surprise that the cryptocurrency Fear and Greed Index moved into “fear” territory, losing 17 points to 33 – its lowest level since October 1st.

Perhaps the following line of defence for the bulls could be the $52.0-53.5K area, where the previous extremes and the 61.8% retracement from the September-November rally are concentrated. One can only wonder how ETHUSD continues to hold its critical $4000 level amid such aggressive pressure on BTCUSD. The first cryptocurrency appears to be under pressure from institutional sell-offs, of which there are drastically less in Ether.

The FxPro Analyst Team