Market picture

Last week saw the launch of 11 spot bitcoin ETFs in the US. On Thursday, the first day of trading, the total volume traded in these ETFs was $4.6 billion, and the price of bitcoin reached a multi-month high near $49000.

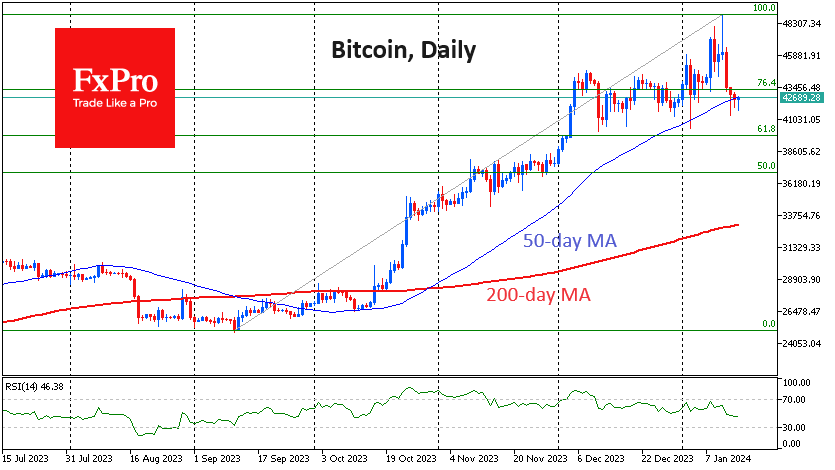

The “sell the facts” pattern was already evident on Friday and continued throughout the weekend. On Saturday, the price fell to $41350, but apart from impulsive drawdowns, the price has spent most of its time around $42600. The 50-day moving average is close to this level, and the bulls are clearly trying to keep the price above this important trend indicator, which has been in place since October.

A corrective pullback in bitcoin to $39-40K would be within the bounds of typical corrections. A drop to an important round level may increase the medium-term attractiveness of the first cryptocurrency.

News background

Several applications for Ethereum spot ETFs are pending with the SEC. However, JPMorgan doesn’t expect such funds to appear in the near future. For that to happen, the SEC would have to recognise ETH as a commodity (like bitcoin) – but the regulator has repeatedly said it considers all cryptocurrencies except BTC to be securities.

Ethereum developers have proposed changes to the ERC-4337 specification to reduce the price of gas for smart account transactions. The main changes in the document concern the structure of smart account transactions.

Cryptocurrency company Ripple Labs has completely abandoned plans for an IPO and is buying back 6% of its shares from employees and early investors for a total of around $285 million.

In a bullish scenario, bitcoin could rise to $1.5 million by 2030, said Katie Wood, CEO of ARK Invest. Even in a bearish scenario, the digital gold exchange rate would rise to $258,500. A conservative estimate suggests a rise to $682,800. Fundstrat previously predicted that BTC would reach $500,000 within the next five years.

The FxPro Analyst Team