Market Overview

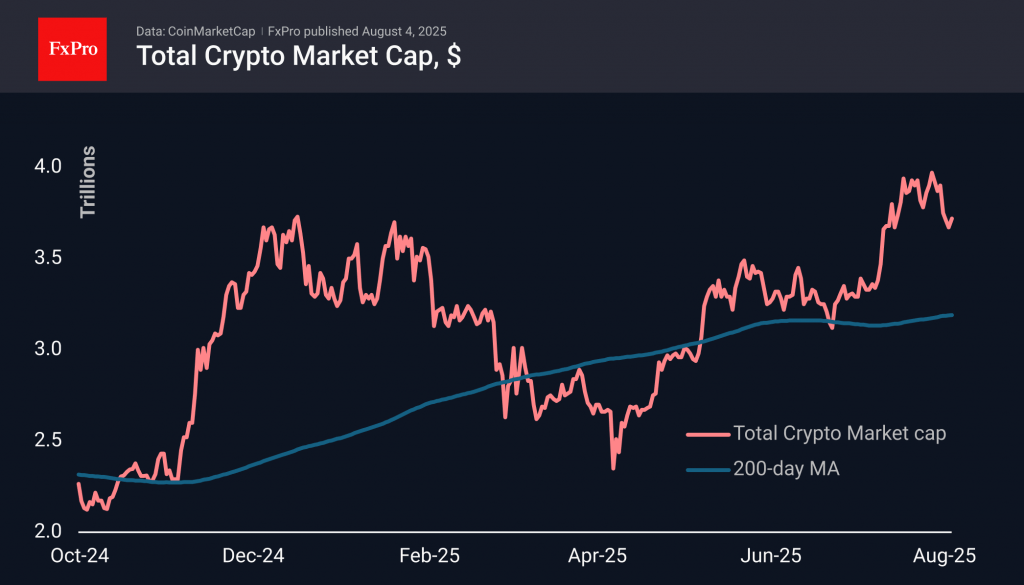

The crypto market rolled back at the end of last week following a reduction in risk appetite in the financial markets. However, on Sunday, sentiment changed with the return of active buyers near the total capitalisation of $3.60 trillion. At the time of writing, the market is at $3.73 trillion (+3.6%). Less than 10% of the top 100 coins show gains over 7 days, among which the largest are TRON (+2.2%) and TON (+4.5%).

The crypto market sentiment index fell to 53 by Sunday morning, a six-week low, but recovered to 64 on Monday, reflecting a resurgence of bullish sentiment. However, another impressive upward move will be needed to confirm a local victory for the bulls.

On Saturday and Sunday, Bitcoin received support from buyers on declines below $112K near the 50-day moving average – the fourth touch of this curve since April. On the “buy the dip” sentiment, the first cryptocurrency recovered to $115K on Monday morning. The rebound from support is a bullish signal for the next couple of days, but the fact that it has been tested frequently raises concerns for the medium term.

News Background

According to SoSoValue, net outflows from spot Bitcoin ETFs in the US amounted to $812.3 million on August 1, the highest since February 25. As a result, the weekly outflow from BTC ETFs amounted to $643 million, a record high for the past 16 weeks.

The net outflow from spot Ethereum ETFs in the US on Friday amounted to $152.3 million. However, inflows in the previous days of the week managed to keep the indicator in positive territory (+$154.3 million). The positive trend has continued for 12 consecutive weeks.

Analyst Ali Martinez says that over the past two days, Bitcoin whales have bought 30,000 BTC. According to Santiment, over the past four months, whales with balances ranging from 10 to 10,000 BTC have accumulated 0.9% of the total coin supply.

According to The Block, trading volume on centralised crypto exchanges exceeded $1.7 trillion in July (the highest since February 2025), and trading volume on decentralised exchanges (DEX) also reached its highest level since January.

Galaxy Digital warned of risks in the public company sector, which accumulates cryptocurrencies by issuing shares. The model creates systemic vulnerability and could lead to a cascade collapse.

US SEC Chairman Paul Atkins announced Project Crypto. The project’s key objective is to establish clear rules for cryptocurrencies and turn the US into the “world’s crypto capital.”

The FxPro Analyst Team