Bitcoin has added 6% over the past seven days, to $24.6K at one point, but now corrected to $23.2K. Ethereum has added 11% to $1700. Top-10 altcoins rose from 4% (Cardano) to 22% (Polkadot).

The total crypto market capitalisation, according to CoinMarketCap, rose 7.5% over the week to $1084bn. Bitcoin’s dominance index fell 0.5 points to 41%.

The Crypto Fear and Greed Index rolled back to 33 by Monday, ranging from 26 on Tuesday to 42 on Saturday during the previous week.

Bitcoin added 27% over July, posting its biggest gain amid the strengthening of stock indices in nine months. Bitcoin failed to recover even half of its June losses. However, the last month and a half have seen a careful price recovery.

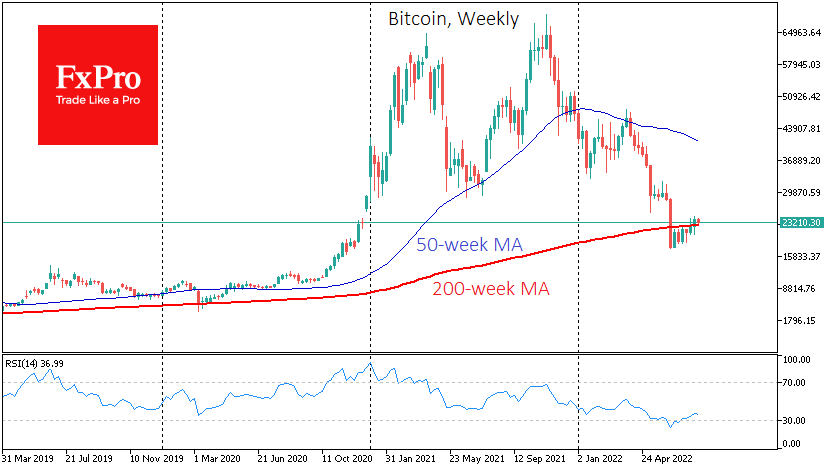

Last week closed above the 200-week moving average, a dip below which was a historical anomaly and called into question the long-term growth trend of cryptocurrencies.

Regarding seasonality, August is considered less favourable for bitcoin than July. Over the past 11 years, bitcoin has ended the month up only five times and down six times. The average rise was 26%, while the average decline was 15%. In the first case, BTC could end August at around $30K, recouping the June decline in two months. In the second, it could be about $20K.

Dan Morehead, Pantera Capital CEO, believes the crypto market has passed its peak after liquidating assets of bankrupt companies in May and June. In his view, even during the height of the crisis, almost all DeFi protocols worked effectively while the centralised credit-linked companies collapsed.

The FxPro Analyst Team