Market Overview

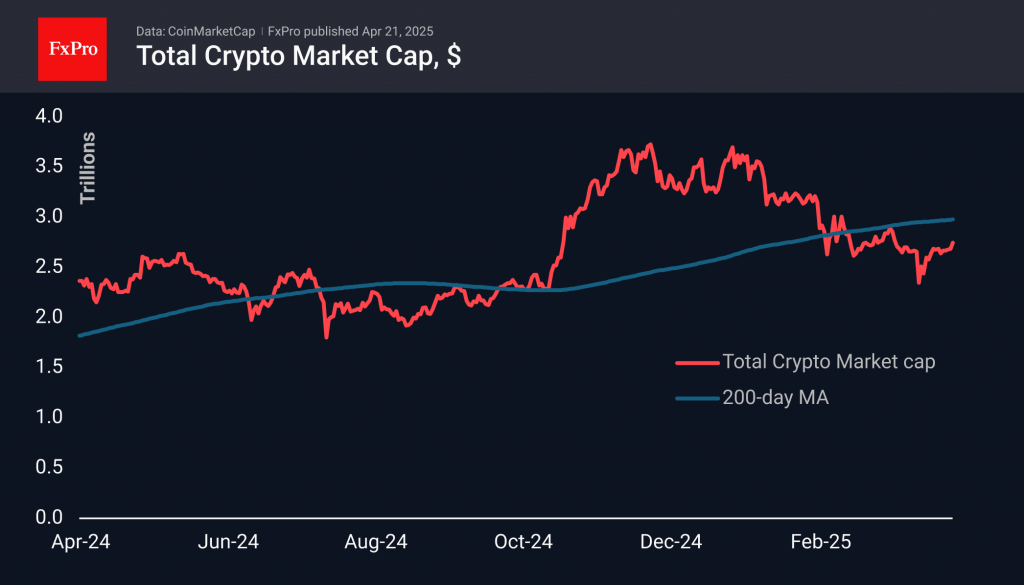

The crypto market has gained 2% over the past 24 hours, reaching $2.75 trillion. This marks a surge to the highest levels in three and a half weeks and an attempt to break upwards from a prolonged consolidation. At this stage, attention is focused on top-tier coins — BTC, ETH, XRP, and BNB — all gaining over 2%. However, among slightly smaller-cap coins, performance remains quite varied.

Bitcoin jumped to $87,500 on Monday, testing the late March highs. The leading cryptocurrency managed to bounce off the 50-day moving average, around which it had been hovering for the past week and a half. A solid close above the $88,000 area would signal a break in the downtrend and a return to levels above the 200-day moving average.

A confident move higher from current levels would be a key signal for the entire market, once again positioning BTC as the flagship set to lead the way.

News Background

Analysts have also pointed to a slowdown in the growth of stablecoin supply in recent weeks. This is another sign of declining liquidity in digital assets.

Barry Silbert, founder of the venture-holding Digital Currency Group (DCG), stated that 99.9% of existing cryptocurrencies are pointless and worthless. According to him, simply holding Bitcoin instead of investing in crypto projects would have made him significantly more money.

Google searches for Bitcoin in March hit their highest levels since the start of the year, rising by 26% over the month. Ethereum showed a similar trend, indicating a revival of interest in digital assets from retail investors, as noted by The Block.

According to Matrixport, ETH’s market share has dropped by nearly 50% since the launch of spot Ethereum ETFs in the US in July 2024. At the same time, Bitcoin remains stable despite its limited liquidity.

The FxPro Analyst Team