Market Overview

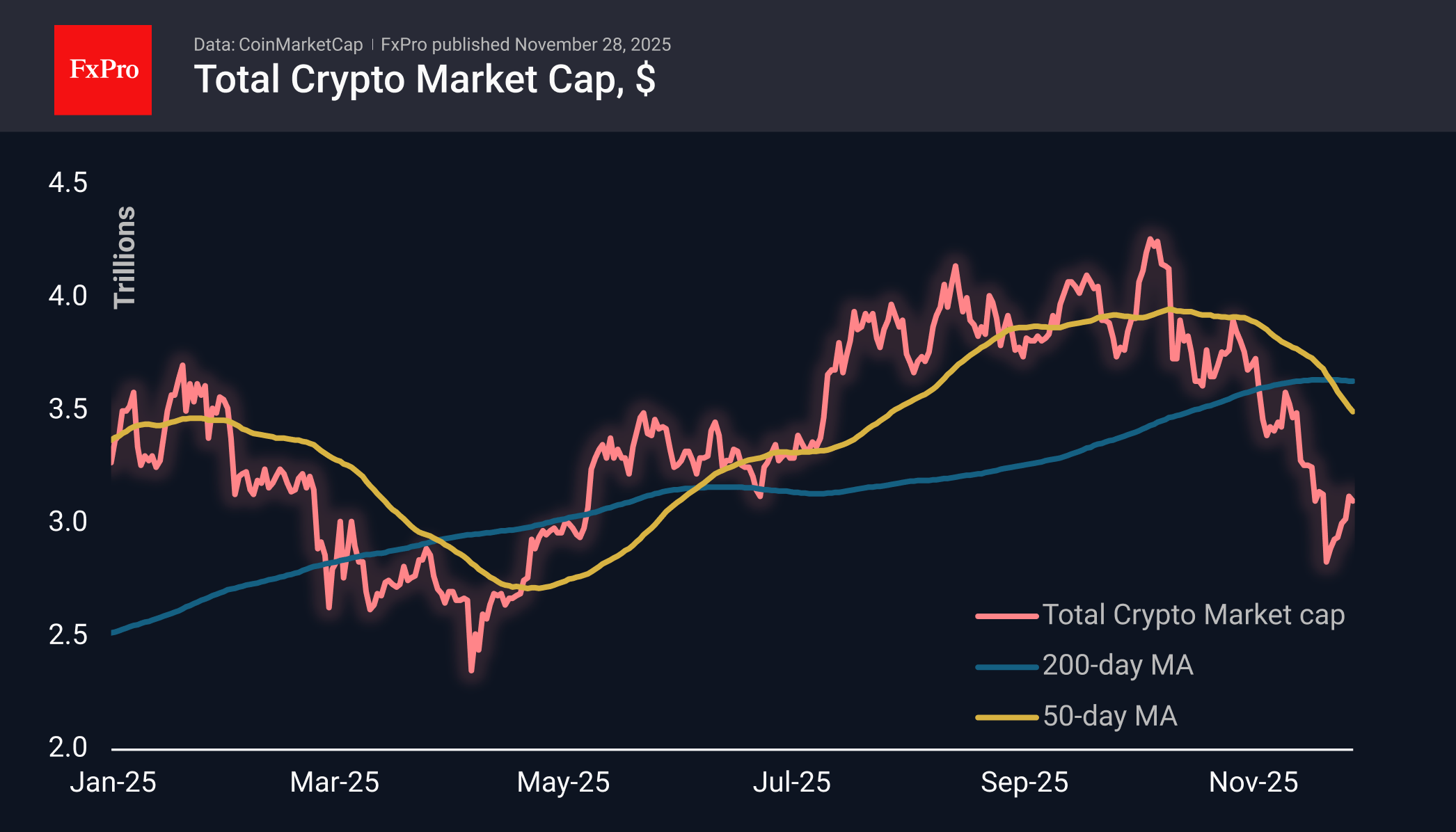

The crypto market cap corrected by 0.4% to $3.10T, pausing the cautious rebound from last Friday. Yet we can’t talk about the rebound running out of steam, as there was strong growth the day before. But we do not see any increase in optimism, as just about one in seven coins has gained in the last 24 hours, compared to a decline for most.

The sentiment index rose to 25, the threshold for exiting the territory of extreme fear, despite the latest round of weakness. The index’s dynamics are likely to attract buyers who were eager to enter the market but were waiting for a discount after the highs were set in early October.

Bitcoin has fallen below $ 91K, stabilising near the 61.8% Fibonacci retracement level of the decline since November 11th. The area near $90K was significant for the market about a year ago, serving as support for the correction after the growth momentum in early November. There is some risk that it will now act as resistance, reinforcing the bearish signal of a possible end to the rebound. A rise above $95K would signal a victory for the bulls and a return to a bull market, while a decline below $87K could open the way to $80K, driving the market into a depression.

News Background

Kronos Research describes the current dynamics as a classic rebound from oversold conditions. The market has cleared out excess long positions, creating room for growth, according to Presto Research.

Futures and options data point to a return of bullish sentiment. The market is ‘ready for growth’ after speculative longs were closed over the past two weeks, according to GSR.

According to CryptoQuant, in November, the Binance crypto exchange increased its stablecoin reserves to a record $51.1 billion. The growth of this indicator can be seen as a positive factor for the crypto market.

The potential exclusion of Strategy from the S&P 500 index and continued outflows from spot crypto ETFs could bring back bearish sentiment and trigger sell-offs, warns QCP Capital.

Bolivia will include cryptocurrencies and stablecoins in its national financial system to modernise it. Cryptocurrencies will be allowed to be used as a means of payment, savings accounts, credit products and loans. The authorities’ decision is a result of the country’s challenging economic situation.

The FxPro Analyst Team