Bitcoin starts the working week near the round level of $13K, once again experiencing bear pressure after growth above $13,100. All weekend the bears and bulls played tug-of-war with no obvious winner. Such price dynamics took place with a gradual decrease in trading volumes, reflecting the expectation of new triggers. The best scenario for Bitcoin would be to consolidate around reached levels, which could lay the ground for further growth.

Bitcoin’s capitalization increased by $30 billion over the week, pushing the total capitalization of the crypto market to $400 billion. The last time this indicator was above $400 billion was in spring 2018. At the end of 2017, when Bitcoin reached a historically high price, the total capitalization of the crypto market was approaching a trillion dollars, as at the time the excitement and volume of purchases were so massive. Nowadays, the crypto market may take much longer to reach such levels, but their strength appears to be increased.

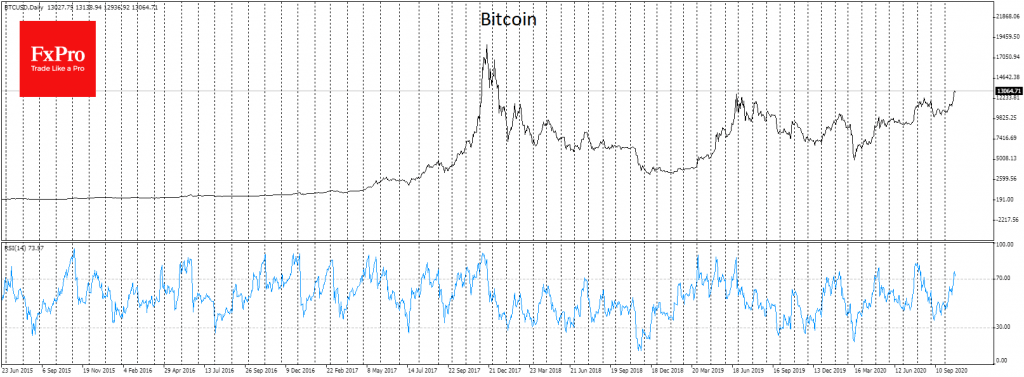

The Crypto Fear & Greed Index is balanced around “greed” and “extreme greed” at the “75” level. The closer the indicator is to “100”, the higher the probability of a corrective sell-off. The RSI for BTC/USD shows signs of a top-down movement from the overbought zone.

PayPal may continue to form a news agenda on the crypto market, as following the announcement of the opportunity to buy and sell cryptocurrencies, the world’s largest money transfer company is declaring its willingness to buy crypto companies. At the moment, PayPal may consider buying BitGo custodial service.

An unexpectedly positive opinion about the prospects for Bitcoin was expressed by the banking giant JPMorgan. The investment bank saw “significant” long-term growth potential in Bitcoin and declared it a competitor to gold. On the last Friday of October, Bitcoin may show a significant surge of volatility as $750 million in CME options expire on October 30th.

Closing this week above $13K could be a very serious fundamental indicator of further dynamics. Of course, prospects will also be influenced by what happens during the week, but the closing of the month, the expiration of futures, and the ability to hold positions may be key factors that will push investors to buy.

The FxPro Analyst Team