Cryptocurrencies were under the pressure of strong data on inflation in the United States on Thursday, which has updated 40-year highs. Such values can force the Fed to raise interest rates faster, which is negative for all risky assets, including cryptocurrencies.

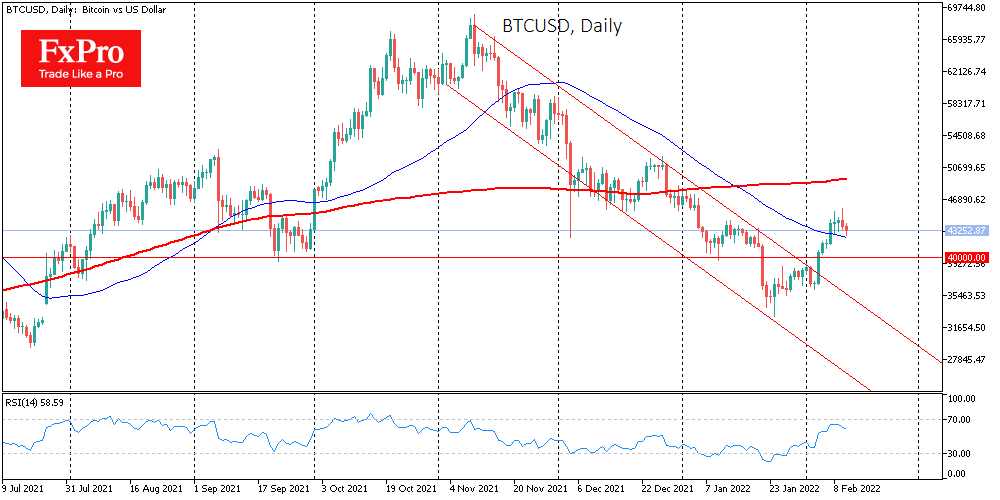

Bitcoin showed high volatility during trading, updating early January highs above $45,800 under the influence of a weakening dollar. However, towards the end of the day, the first cryptocurrency began to decline along with stock indices: the S&P500 lost 1.8%, the high-tech Nasdaq fell 2.1%.

The crypto-currency index of fear and greed for the second day is exactly in the middle of the scale, at around 50 (neutral). However, now the stock markets are having an increased impact on the dynamics of Bitcoin and Ethereum, in which the prospects for monetary policy are being reassessed. The corresponding index is now in the fear territory, near the 37 mark.

Meanwhile, Bitcoin is being bought back on dips towards the 50-day average, which keeps the picture bullish. However, in the event of a prolonged sale of shares, the first cryptocurrency will not hold and risks pulling the entire market with it.

XRP and Solana have both lost around 6% over the past 24 hours, falling amid a general reduction in risk traction in the markets and the two largest cryptocurrencies.

Despite the apparent depth of the pullback, XRP remains 32% above levels from a week earlier, and the current retreat is well within Fibonacci technical correction from the rally of the past eight days.

A drop below $0.78 would signal a deeper correction and open a quick path to $0.75. If all of February’s gains are entirely nullified in the coming week and quotes pull back to below $0.60, it would be safe to speak of a new depressed period with a long-term downside potential of 50% to $0.3.

The technical picture in Solana and Polkadot is worse, as a shadow hangs over them. The rise from January 28th to February 7th looked like a technical rebound after being oversold since November. But this growth momentum is quickly fading. We can say for this coin that without positivity for the overall market, it will continue to lose ground faster than BTC and ETH.

The FxPro Analyst Team