Bitcoin was down 3.4% on Thursday, ending the day near $39.9K, although it managed to bounce back above $40.1K by Friday morning, cutting the intraday decline to 2.8%. Ethereum has lost 2.5% in the last 24 hours, and other leading altcoins from the top ten are predominantly declining, from -1% (BNB) to -7.3% (Terra). The exception was XRP, which added 5.4% during this time.

The total capitalization of the crypto market, according to CoinMarketCap, decreased by 2.8% per day, to $1.87 trillion. The Bitcoin dominance index fell by 0.3% to 40.7%.

By Friday, the cryptocurrency fear and greed index returned to the extreme fear territory, losing 6 points to 22. US stocks failed to build on the offensive, losing all the previous day’s gains, leading to a stronger selloff for bitcoin compared to alternative cryptocurrencies.

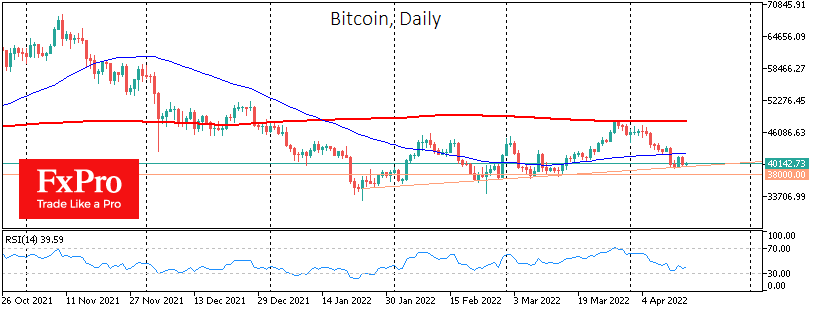

From the technical side, Bitcoin is trading near the support level, which runs through the lows of January, February, and March. A formal signal to break the support will be considered a failure under the previous lows in the $38K area. The ability to develop a reversal to the offensive from these levels, on the contrary, will reinforce the importance of this moderate uptrend line.

The head of Ripple noted that the court with the SEC is going “much better than expected,” which provoked a wave of XRP growth, allowing the coin to resist gravity.

BlackRock CEO Larry Fink said that the largest asset management company continues to study the cryptocurrency sector.

Amazon CEO Andy Jassy said that the company has no plans to introduce payments in cryptocurrency soon, although it is exploring the possibilities of digital assets. At the same time, he looks to the future of cryptocurrencies and NFTs with interest and optimism.

The Bank of Canada is exploring scenarios for the coexistence of digital and fiat currencies, the first regulator to decide to use quantum computing for this study.

Bank of Japan chief executive Shinichi Uchida said the upcoming digital yen will not be used to achieve a negative interest rate. The second stage of the launch of the digital yen started on March 24th this year.

The FxPro Analyst Team