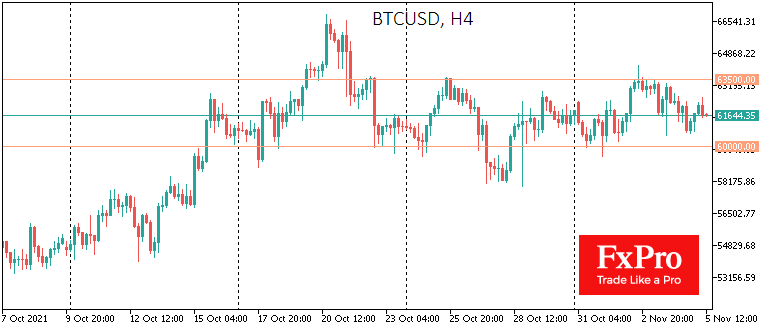

Bitcoin remains sideways, barely moving out of the $60-63.5 range for the past two weeks. A dip towards the lower end of the range late on Friday morning has been redeemed, and the BTCUSD exchange rate has returned to $62.2K. Interestingly, the price surge to the highs of October 20 was later counterbalanced by a proportional dip, making the area near $61.50K the centre of equilibrium for bitcoin over the past four weeks.

A similar balancing act can be seen in the cryptocurrency Fear and Greed Index, which has been moving at levels just above 70 since early October, showing a mark of 73 in the last 24 hours, firmly in Greed territory.

Against the backdrop of Bitcoin stabilisation and cryptocurrency “greed”, interest in altcoins continues to rise. Cryptocurrency market capitalisation ex BTC has added 26% over the past month, although it has faced several sharp declines.

Among the week’s top coins, Binance Coin (+21.7% in 7 days), Solana (+21.7%) and Polkadot (+22.6%) shone. On the other hand, Dogecoin was depleted by the battle, with Dogecoin losing 9.5% and Shiba Inu losing 28%.

Bitcoin’s steady burn at one level is feeding risk appetite among crypto enthusiasts.

Bitcoin seems to have become so liquid and inert, and demand has gone so much into the ‘new stars’ that it hasn’t even been moved upwards by the latest news from New York. A man who promised to turn the city into a crypto hub was elected mayor there. And yesterday, he said he would get his first three salaries in BTCs. Of course, there is no economic effect in the latter, but it would have had an important psychological impact a year ago, noticeably pushing the price upwards.

Do Bitcoin’s inertia and the failure of last week’s two doglegs mean the end of this bullish wave? So far, it’s hardly a valid thesis: active speculators in the cryptocurrency market are jumping from one coin to another, trying to ride the small (in volume but not height) waves. This is a positive-sum game if the tide is turning, that is, if the overall capitalisation of the crypto market is rising.

When will the tide turn? That depends on the global demand for risk, which correlates with central bankers’ stance and inflation trends. Recent comments from central bankers have made it clear that regulators continue to look the other way on inflation, expecting it to subside on its own without raising interest rates. This is good news for cryptocurrencies with limited supply, such as Ether.

At some point, the tide will turn, and then those currently riding the high tide risk finding themselves far out in the shallows. However, that moment is in no hurry to arrive.

The FxPro Analyst Team