Market picture

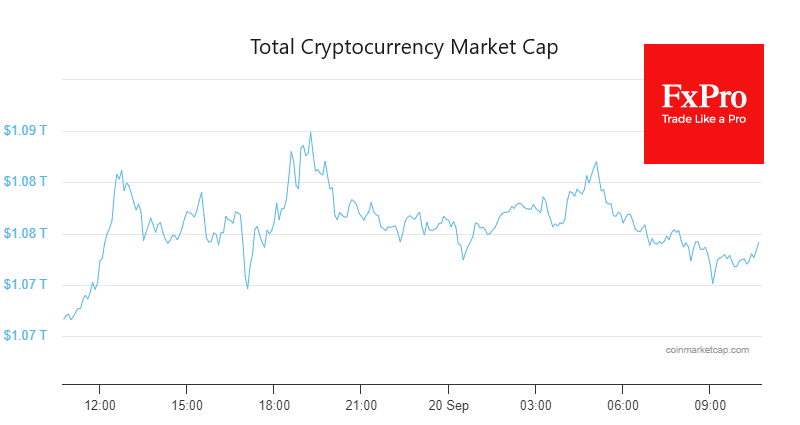

The crypto market has been trading around 1.08 trillion over the last day. The trading range is narrowing as the Fed decision approaches. However, it is worth highlighting the pressure on the markets early on Wednesday and the intensification of cryptocurrency selling as the cap rises towards 1.09 trillion.

Bitcoin encountered resistance at $27.4K. Attempts to break above the 50-day moving average for the third day met strong resistance. All financial markets have taken a wait-and-see approach ahead of monetary policy decisions in the US, Switzerland, the UK, and Japan.

The situation for Bitcoin is bearish if one looks solely at the technical picture on the chart. The corrective bounce in BTC is formally over; the price has fallen below the moving averages, and the short-term oversold condition is complete.

In another recalculation, bitcoin’s mining difficulty rose 5.48% to 57.12 T. According to Glassnode, the smoothed 7-day moving average hit a high of 423.4 EH/s.

News background

According to K33, trading volumes on the Binance exchange fell by 57% over the week. Users are moving to other trading platforms that have not yet been subject to regulatory crackdowns.

The court declined to order Binance’s US unit to provide the SEC with more information about handling customer funds. Instead, the district judge urged the two sides to work together.

SEC Commissioner Esther Pierce urged cryptocurrency companies not to leave the US. She said she was frustrated by the agency’s reluctance to clarify cryptocurrency regulation.

Massive applications to launch spot bitcoin ETFs are revitalising the crypto market and could be a catalyst for bitcoin’s growth, Matrixport believes. BTC’s cryptocurrency market dominance is approaching 50 per cent and is set to grow.

Laser Digital Asset Management, a subsidiary of Japan’s largest investment firm, Nomura, launched a Bitcoin fund for long-term institutional investment.

Citigroup launches Citi Token for business-to-business payments and trade finance based on blockchain technology and smart contracts.

The FxPro Analyst Team