Bitcoin moved out of an almost month-long sideways corridor, shooting up 6% in the last 24 hours. As recently as late last week, it needed support on the downside towards $60K, but it received steady demand over the weekend. Going above $63.5K triggered a wave of optimism, quickly sending the price of the first cryptocurrency to highs near $66K.

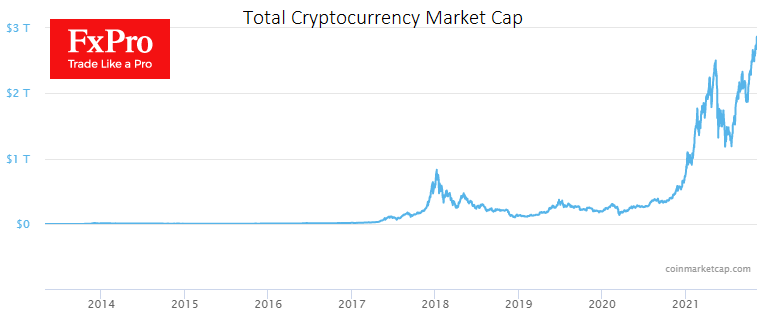

The cryptocurrency fear and greed index has not yet kept pace, stopping at 75, and has been hovering in the greed area since the middle of last month. Crypto market capitalisation, both with and without bitcoin, is updating all-time highs, indicating that the whole bitcoin spike may be a secondary effect in the current altcoin season.

Bitcoin has ample room to rise on the technical analysis side, as the bulls have built-up strength during the first cryptocurrency’s month-long consolidation. The RSI index has entered neutral territory after being overbought from October’s rally in recent days.

After a prolonged consolidation, the jump in bitcoin price paves the way to $83K, corresponding to 161.8% of the late September to mid-October rally. Investors in the crypto market should be prepared that this part of the rise could materialise rather quickly.

History suggests that entering the territory of new highs for Bitcoin attracts extensive attention and money, amplifying the rally in the early days until headlines about another historic high for the first cryptocurrency and the overall capitalisation of the crypto market become commonplace.

For seasoned cryptocurrency investors, however, altcoin’s surge and bitcoin’s lag, as well as the timing of this event, raise unpleasant analogies with the end of 2017. Back then, the altcoin rally was particularly fierce from November to January. Many of the altcoins then and now are still a long way from those highs.

The FxPro Analyst Team