Market picture

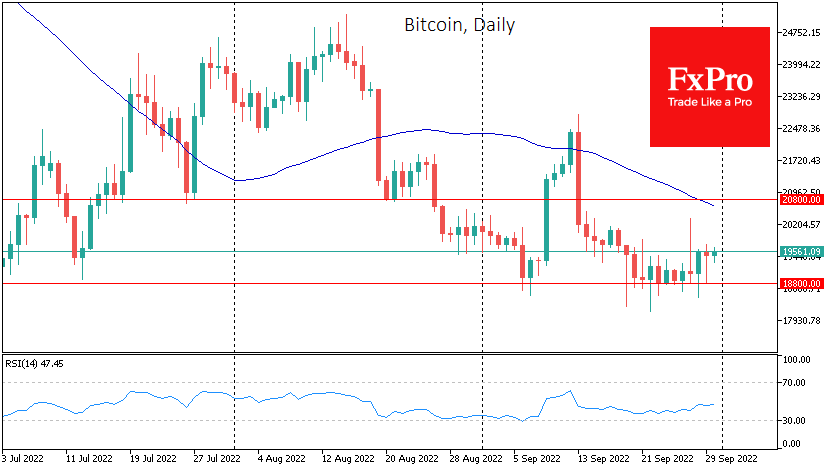

Bitcoin has remained in position for the past few days, trading at $19,500 on Friday morning. As in previous days, the attempt to sell the cryptocurrency following the stock market was met with buying.

This neat bottom-drawing by Bitcoin could show a wait-and-see stance and consolidation before the next move. However, crypto optimists are now siding with the positive momentum in gold and sector stocks. Investors have probably recalled them as a store of value amid the volatility in the currency market.

Among the closest key levels, the $20.8K where the 50-day moving average is located is worth mentioning. It has been active as resistance for more than a month. Local support is near $18.8K. A move outside this range could signal the end of the current consolidation.

News background

Billionaire Stanley Druckenmiller expects the US economy to deteriorate significantly by the end of next year. That’s when cryptocurrencies could make a resurgence.

Alexander Hoptner, CEO of cryptocurrency exchange BitMEX, said he does not see any decline in institutional investor interest in the crypto industry, despite the bearish trend.

Lastly, BlackRock has launched on Euronext, an exchange-traded fund (ETF) focusing on blockchain and cryptocurrency companies.

The FxPro Analyst Team