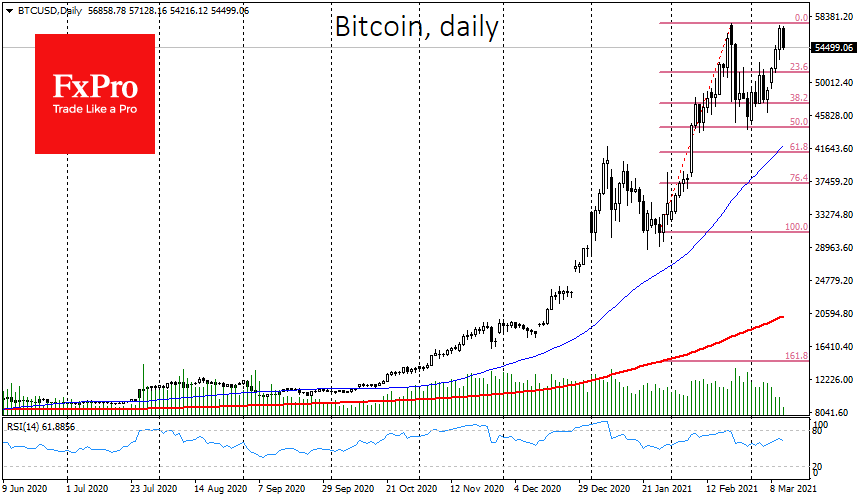

Just like a week ago, the bulls and bears are playing tug-of-war. However, there is one major difference; whereas a week ago, the fight was near the $50K level, market participants are now aiming for a retest of the historical high. After dipping as low as $53,500, buyers have re-entered the main stage and pushed Bitcoin to $57K. There is a good chance that the benchmark cryptocurrency will head into territory above $60K.

Bitcoin’s capitalization is once again above $1 trillion, and that level is still a very serious test for the first cryptocurrency. However, according to Material Indicators, Bitcoin’s recent decline has been used by whales and institutionalists to buy the asset on a slight downturn. The analysis showed that orders to buy the asset at a value of $100K or more on the largest exchange, Binance, reached an all-time high. In addition, orders for $100K to $1M also showed significant growth.

Altcoins are showing moderate growth. At this stage, investments in alternative cryptocurrencies concern more retail non-professional investors. Therefore, even if Bitcoin rises sharply above $60K, we may not see altcoins’ immediate reaction.

At the moment, the leading altcoin Ethereum (ETH) is showing a noticeable positive trend with 13% growth in a week. Ethereum developers believe that after the update, the network’s scalability will grow by a factor of 100. Frequently released news about the development team’s progress on the transition to Ethereum 2.0 fuels the cryptocurrency’s value.

This all plays into the hands of miners, who are once again buying back every batch of graphics cards on the new chips, leading to unwanted consequences, including higher prices and no graphics cards freely available. The situation has become so critical that it has forced Nvidia to declare a software lock on the power of the new chips. Nevertheless, no one doubts that there will be ways to use the resource of cards to the maximum.

The situation is somewhat reminiscent of January 2018, when we saw the peak of the mining boom, which ended with a sharp drop in coin prices, as well as the bankruptcy of most miners who came to the market at the height of the hype. So while the composition of investors in the crypto market is very different from the rally of 2017 at this point, there is still a high probability that we are now in the final stages of a bull market.

This doesn’t mean that Bitcoin won’t show new all-time highs, but when investing in any cryptocurrency at this stage, one should be prepared for a significant waiting period for new highs. Remember, many altcoins never managed to overcome the peaks of three years ago.

The FxPro Analyst Team