Market picture

Bitcoin has rallied over 9% in the past 24 hours, returning to August highs and peaking near $25,000. The move looked like a short squeeze following softer-than-feared comments from the SEC. At the same time, we note that the optimism was concentrated in Bitcoin and Ethereum.

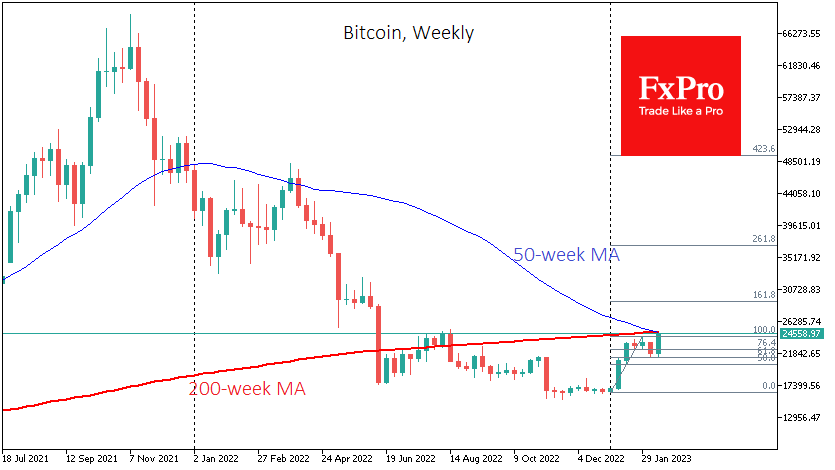

The short-term technical picture has become even more bullish. Bitcoin has turned higher after correcting 61.8% of the rally since the beginning of the year and has rewritten previous highs with strong momentum. The next Fibonacci target is at 29,000, which coincides with the consolidation area from last May.

However, the picture on the weekly chart suggests that a serious tug-of-war may be taking place at current levels. A “death cross” pattern forms at 24.9, where the 50-week crosses the 200-week. And the price is now below that cross. History suggests that bitcoin gets stuck near this long curve for many weeks.

News background

Dan Morehead, CEO of cryptocurrency hedge fund Pantera Capital, said that the bear cycle in the cryptocurrency market ended in November and that bitcoin will rise. He said confidence in the cryptocurrency industry is rebounding, no matter what happens in the risky asset market.

Stablecoin issuer USDC Circle refuted Fox Business’ information about possible reprisals from the SEC. Earlier, one of the network’s reporters tweeted that Circle had been ordered to stop selling “unregistered securities”.

Changpeng Zhao, chief executive of the Binance exchange, believes the industry could move to stablecoins pegged to other fiat currencies because of recent nagging from US regulators over the BUSD.

The ECB has urged EU banks to apply the Basel Committee on Banking Supervision’s restrictions on crypto assets before they come into force. Implementing the Basel standard for regulating crypto-asset risk for banks is expected to be completed by 1 January 2025.

The FxPro Analyst Team