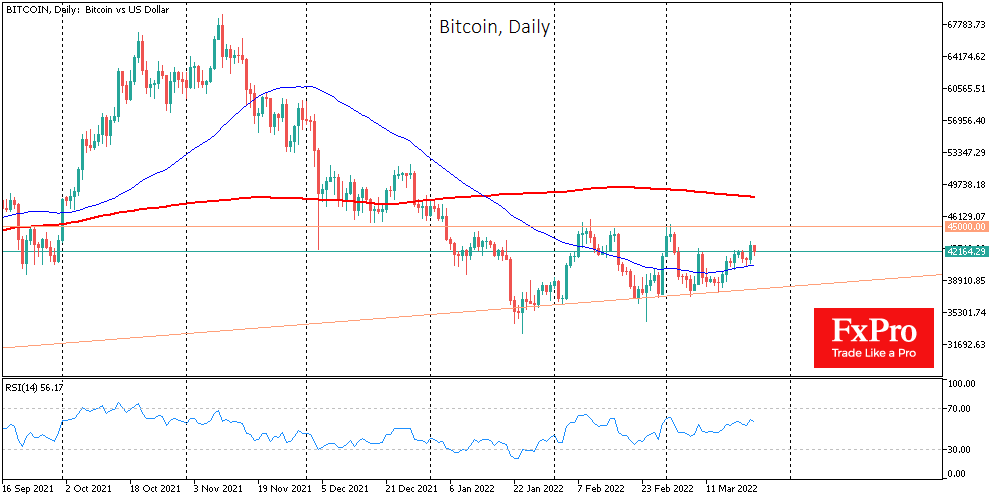

BTC rose 3.5% on Tuesday. At the peak of the day, the rate exceeded $43.2K, but by Wednesday morning it rolled back to $42K, demonstrating a 0.7% correction. Ethereum is losing 1% over 24 hours, while other leading altcoins from the top ten showed mixed dynamics yesterday: from a decline of 2.7% (Avalanche) to a rise of 3.8% (Polkadot).

According to CoinMarketCap, the total capitalization of the crypto market decreased by 0.5%, to $1.91 trillion. The Bitcoin dominance index fell by 0.1% to 41.9%. The Cryptocurrency Fear and Greed Index added another 5 points to 31, although it remains in a “fear” state.

Bitcoin tested 19-day highs above $43,000 supported by stock indexes with Chinese equities predominantly pulling it. BTC rose sharply during the Asian session, adding about $2,000 in a few hours, although a corrective mood then prevailed. Bitcoin clearly doesn’t have a reason for a solid establishment on the path of growth yet.

At the moment, on-chain metrics are consistent with a bear market, Glassnode notes. The rise in implied volatility and higher leverage in the derivatives market point to the possibility of a sharp swing in bitcoin.

However, the sell-off in “defensive” developed-country government bonds continues in financial markets as investors park their money in stocks and commodities that provide the best hedge against prolonged and high inflation. At the same time, there are no clear signs of an economic and financial catastrophe that could hurt stocks or commodities.

The world’s largest hedge fund Bridgewater Associates plans to invest in one of the third-party crypto funds, pointing to the risks for fiat currencies, which lose sharply during periods of military and economic wars.

The FxPro Analyst Team