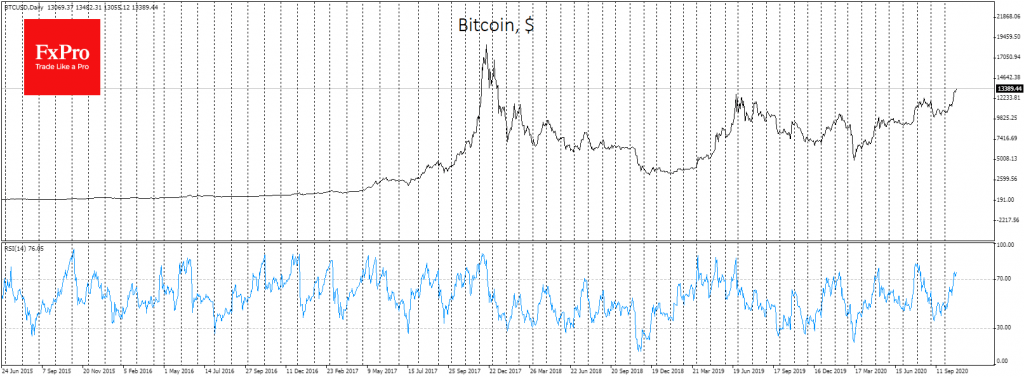

Bitcoin is now in a better position to continue its growth, having almost reached the highs of the last three years. More recently, it has entered the area above 13,000 and still shows few signs of a corrective rollback.

Behind these purchases are some fundamental factors. Firstly, there is a wide understanding that the bull cycle is based on the third halving, held in May. The result is pressure on the Bitcoin supply at a time when buyers around the world are losing confidence in national currencies, whose value is being eroded by a printing press operating at full capacity.

More locally, the driver was PayPal’s announcement to integrate the ability to buy and sell major cryptocurrencies, including Bitcoin. This makes it much easier for retail investors to access the crypto market. Before this, significant investment companies, including Square, MicroStrategy and Stone Ridge, invested in Bitcoin.

Risks for Bitcoin still exist, however. The main one is potential deleveraging on financial markets. If the slippage of stock indices turns into a collapse, Bitcoin could repeat its March decline, when its price more than halved. Supposing this extremely unfavourable scenario can be avoided (through a government stimulus package or Fed support measures), BTCUSD may not encounter significant resistance up to highs above $20000 and could potentially reach them in the coming months.

The FxPro Analyst Team