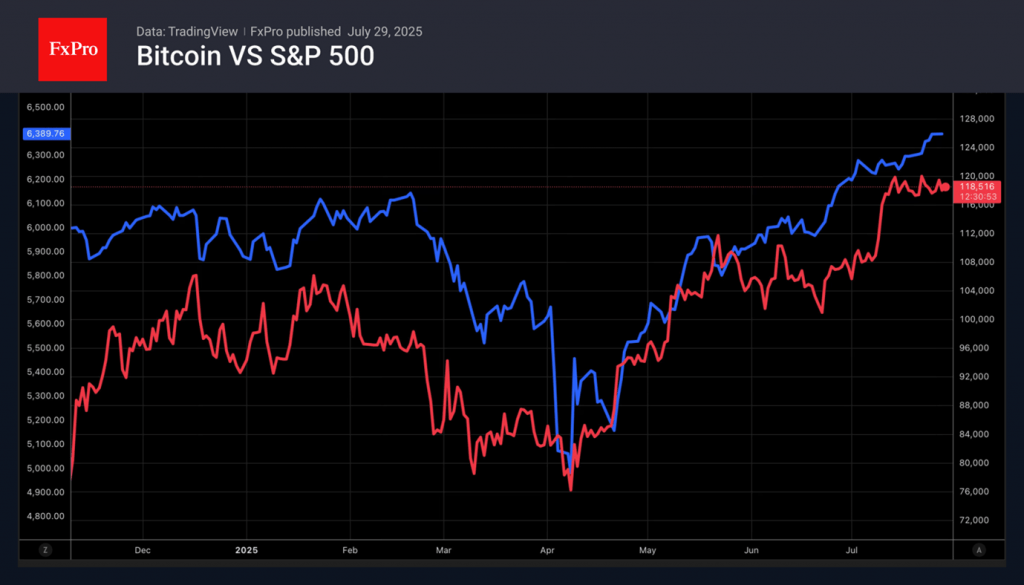

After a turbulent rally in the first half of July, Bitcoin entered a period of consolidation. Neither the sixth consecutive record high of the S&P 500 nor the associated improvement in global risk appetite are helping it. At the same time, the medium- and long-term outlook for Bitcoin remains bullish. Citigroup expects to see the cryptocurrency at $135K by the end of 2025.

While individual traders are staying away from Bitcoin’s consolidation, institutional investors are active in the ETF market, and retailers and banks are beginning to integrate digital assets into their operations actively. For example, PayPal has announced plans to use stablecoins to transfer transactions to merchants’ accounts. With 650 million cryptocurrency users worldwide and $3 trillion in wallets, this needs to be taken into account and applied.

Goldman Sachs and BNY Mellon are exploring the possibility of introducing stablecoins into the money market fund sector. These institutions manage approximately $7.2 trillion in funds. Tokenisation can help managers reduce costs and the time required to settle transactions.

The White House’s loyalty and the creation of a regulatory framework are fuelling institutional investor demand for the crypto market. Open interest in derivatives linked to Black Rock’s largest Bitcoin ETF, iShares Bitcoin Trust, has tripled to $34 billion since the beginning of 2025. Daily trading volumes exceed 4 billion dollars. Only highly liquid specialised funds of US stocks and gold are traded more actively.

Meanwhile, corporate treasuries are devising new ways to raise money to buy digital assets. Strategy, for example, has announced the issuance of preferred shares with a yearly yield of 9%. Michael Saylor’s company currently owns 3% of all Bitcoins in circulation, worth more than $70 billion.

The consolidation of Bitcoin should not confuse investors. Major players, treasuries, and retailers are actively integrating tokens into their activities during the lull in the crypto market. Sooner or later, Bitcoin will break out of the $116K–$120K trading range, and then it will be possible to catch a serious move.

The FxPro Analyst Team